Page 20 - vodafone

P. 20

18 Vodafone Group Plc

Annual Report 2013

Key performance indicators

Our performance

over the year

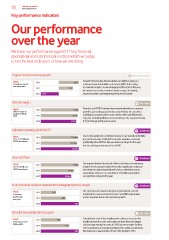

We track our performance against 12 key inancial,

operational and commercial metrics which we judge

to be the best indicators of how we are doing.

Organic service revenue growth More work to do

Target: 2011 2.1% * Growth in the top line demonstrates our ability to grow our

To maximise service customer base and stabilise or increase ARPU. It also helps

revenue growth.

2012 1.5% * to maintain margins. As we anticipated at the start of the year,

we missed our service revenue target because of ongoing

2013 -1.9% * macroeconomic and regulatory pressures in Europe.

EBITDA margin On-track

Target: 2011 32.0% Trends in our EBITDA margin demonstrate whether our revenue

EBITDA margin to growth is generating a good return and whether we can offset

stabilise by March underlying cost pressures in our business with cost eficiencies.

2014. 2012 31.2%

This year excluding M&A and restructuring costs, margins fell only

*

2013 29.9% 0.1 percentage point year-on-year.

Adjusted operating proit (‘AOP’) Achieved

Target: 2011 £11.8bn Due to the signiicant contribution made to our overall proitability

£11.1–£11.9 billion in by our US associate, VZW, AOP is a better indicator of overall

2013 inancial year.

2012 £11.5bn proitability than EBITDA. We exceeded our target for the year

due to a strong performance from VZW.

2013 £12.0bn

Free cash low Achieved

Target: 2011 £7.0bn Our regular dividend is paid out of free cash low, so maintaining

£5.3–£5.8 billion in a high level of cash generation (even after signiicant continued

2013 inancial year. 2012 £6.1bn investment in capital expenditure) is key to delivering strong

shareholder returns. Free cash low of £5.6 billion was within

2013 £5.6bn our guidance range for the year.

% of consumer contract revenue from integrated plans (Europe) Achieved

Target: 2011 27% Our strategic push towards integrated plans allows us both

To increase to defend our revenue base from voice and SMS substitution,

signiicantly and to monetise future data demand growth.

each year. 2012 44%

2013 67%

Smartphone penetration (Europe) On-track

Target: 2011 19% Smartphones are the key to giving our customers access to the

To increase to over mobile internet; the more our customers have them, the bigger

50% by 2015. our data opportunity becomes. In 2010, we set a target of at least

2012 27%

35% smartphone penetration by March 2013, which we achieved.

2013 36% We now have a new ambition of over 50% by March 2015.