EASTSPRING INVESTMENTS

DINASTI EQUITY FUND

INTERIM REPORT

FOR THE SIX MONTHS FINANCIAL PERIOD

ENDED 31 DECEMBER 2019

Dear Valued Investor,

Greetings from Eastspring Investments Berhad!

First and foremost, we would like to take this opportunity to thank you for

choosing to invest with Eastspring Investments Berhad.

We are pleased to enclose a copy of the Annual/Interim/Quarterly Fund

Reports of Eastspring Investments Berhad’s fund(s) for the reporting

period ended 31 December 2019.

You may also download these reports from our website at

www.eastspring.com/my

Should you require any assistance, please do not hesitate to contact our

Client Services at 03-2778 1000.

Yours sincerely,

Raymond Tang Chee Kin

Non-Independent, Executive Director and Chief Executive Officer

TABLE OF CONTENTS 1

3

Fund Information 6

Key Performance Data 12

Manager’s Report 13

Market Review 16

Rebates and Soft Commissions

Statement by the Manager 17

Trustee’s Report to the Unit Holders of

18

Eastspring Investments Dinasti Equity Fund 19

Shariah Adviser’s Report to the Unit Holders of 20

21

Eastspring Investments Dinasti Equity Fund 22

Unaudited Statement of Comprehensive Income 23

Unaudited Statement of Financial Position 32

Unaudited Statement of Changes in Equity 69

Unaudited Statement of Cash Flows

Summary of Significant Accounting Policies

Notes to the Unaudited Financial Statements

Corporate Directory

Interim Report

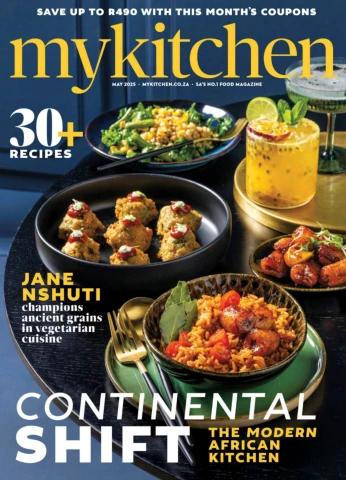

FUND INFORMATION

Name of Fund Eastspring Investments Dinasti Equity Fund (the “Fund”)

Fund Category/ Shariah equity/growth

Type

Fund Objective The Fund aims to provide investors with long-term capital

appreciation by investing in Shariah-compliant investments with

Performance exposure to the Greater China region.

Benchmark

ANY MATERIAL CHANGES TO THE FUND’S OBJECTIVE

WOULD REQUIRE UNIT HOLDERS’ APPROVAL.

The performance benchmark of the Fund is Dow Jones Islamic

Market Greater China Index (“DJM Greater China Index”).

Source: www.djindexes.com

Note: The risk profile of the Fund is different from the risk

profile of the performance benchmark.

Fund Income Incidental

Distribution Policy

Client Services : 03-2778 1000 1

Eastspring Investments Dinasti Equity Fund

FUND INFORMATION (CONTINUED)

Breakdown of Unit As at 31 December 2019, the size of Eastspring Investments

Holdings by Size Dinasti Equity Fund stood at 1,425.804 million units.

1,800 Fund Size

1,600

Units (Million) 1,400

1,200

1,000 Jul Aug Sep Oct Nov Dec

2019 2019 2019 2019 2019 2019

800

600

400

200

0

Breakdown of Unit Holdings

Unit Holdings No. of % No. of %

Units Unit*

Holders (‘000)

5,000 units and below 2,546 17.08 7,342 0.51

5,001 to 10,000 units 2,774 18.62 20,684 1.45

10,001 to 50,000 units 6,944 46.60 166,893 11.71

50,001 to 500,000 units 2,584 17.34 276,342 19.38

500,001 units and above 954,540 66.95

Total 54 0.36 1,425,801 100.00

14,902 100.00

* excludes units held by the Manager.

2 Client Services : 03-2778 1000

Interim Report

KEY PERFORMANCE DATA

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER

Category 2019 2018 2017

(%) (%)

Quoted Shariah-compliant securities (%)

Basic Material 5.31 3.70

Consumer Goods 3.89 9.73 10.15

Consumer Services 10.73 3.95

Financial 12.80 4.63 5.12

Health Care 2.42 2.04

Industrial 2.86 6.12 4.69

Oil & Gas 1.42 3.11 9.15

Technology 8.71 38.77 2.60

Telecommunication 2.82 7.82 42.85

Utilities 43.32 7.58 7.37

5.91 89.44 4.63

Cash and other assets 4.64 10.56 92.30

Total 97.10 100.00 7.70

2.90 100.00

100.00

Client Services : 03-2778 1000 3

Eastspring Investments Dinasti Equity Fund

KEY PERFORMANCE DATA (CONTINUED)

Category 2019 2018 2017

Net Asset Value (NAV) (RM'000) 858,057 778,693 393,965

Units In Circulation (Units '000) 1,425,804 1,548,883 616,714

Net Asset Value Per Unit (RM)

Highest Net Asset Value Per Unit (RM) 0.6018 0.5027 0.6388

Lowest Net Asset Value Per Unit (RM) 0.6104 0.6105 0.6395

Total Return (%) 0.5125 0.5016 0.6299

- Capital Growth

- Income Distribution 12.19 (16.09) 13.08

Total Return (%) - - -

Gross Distribution Per Unit (RM)

Net Distribution Per Unit (RM) 12.19 (16.09) 13.08

Management Expense Ratio (MER) (%)* - - -

Portfolio Turnover Ratio (PTR) (times)^ - - -

0.98 0.97 1.04

0.41 0.31 0.76

* There were no significant changes to the MER during the period under review.

^ There were no significant changes to the PTR during the period under review.

4 Client Services : 03-2778 1000

Interim Report

KEY PERFORMANCE DATA (CONTINUED)

1 year 3 years 5 years

1.1.2019 to 1.1.2017 to 1.1.2015 to

31.12.2019 31.12.2019 31.12.2019

(%) (%) (%)

Average total return 24.74 11.16 12.41

Year ended 1.7.2018 to 1.7.2017 to 1.7.2016 to 1.7.2015 to 1.7.2014 to

Annual total return 30.6.2019 30.6.2018 30.6.2017 30.6.2016 30.6.2015

(%) (%) (%) (%) (%)

(6.71) 10.53 36.76 (3.57) 23.88

Source: The above total return of the Fund was sourced from Lipper for Investment Management.

Bases of calculation and assumptions made in calculating returns:

Percentage growth = NAVt -1

NAV0

NAVt = NAV at the end of the period

NAV0 = NAV at the beginning of the period

Performance annualised = (1 + Percentage Growth)1/n - 1

Adjusted for unit split and distribution paid out

for the period

n = Number of years

Past performance is not necessarily indicative of future performance and unit

prices and investment returns may go down, as well as up.

Client Services : 03-2778 1000 5

Eastspring Investments Dinasti Equity Fund

MANAGER’S REPORT

Fund Performance Over the 5-year period, the Fund recorded a return of 79.54%,

outperforming the benchmark return of 70.70% by 8.84%.

During the period under review, the Fund registered a return of

12.19%, outperforming the benchmark return of 11.55% by

0.64%.

The outperformance was largely due to Shariah-compliant stock

selection in the technology and consumer sectors.

Eastspring Investments Dinasti Equity Fund

- 5 Years Return Vs Benchmark

5 years % Return100% 100%

90% May Aug Dec Apr Aug Dec Apr Aug Dec Apr Aug Dec Apr Aug 90%

2015 2015 2015 2016 2016 2016 2017 2017 2017 2018 2018 2018 2019 2019

80% 80%

70% 70%

60% 60%

50% 50%

40% 40%

30% 30%

20% 20%

10% 10%

0% 0%

-10% -10%

Dec

Dec 2019

2014

Eastspring Investments Dinasti Equity Fund Benchmark

The performance is calculated on NAV-to-NAV basis with

gross income or dividend reinvested.

Benchmark: Dow Jones Islamic Market Greater China Index

(“DJIM Greater China Index“).

Source: Lipper for Investment Management and

www.djindexes.com, as at 31 December 2019.

Past performance of the Fund is not necessarily indicative

of its future performance.

6 Client Services : 03-2778 1000

Interim Report

MANAGER’S REPORT (CONTINUED)

Analysis of Fund For the financial period ended 31 December 2019:

Performance

Income Capital Total Total Return of

Return Return* Return Benchmark

(%) (%) (%) (%)

0.00 12.19 12.19 11.55

* Capital return components (NAV per unit to NAV per unit).

Distribution/ No distribution or unit split were declared for the financial period

Unit Split ended 31 December 2019.

Investment The fund increased Shariah-compliant equity exposure and

Strategy During positioning in higher beta sectors such as consumer discretionary

the Period Under and information technology amidst earnings upgrades and

Review attractive valuations.

The Fund continues to focus on Shariah-compliant stock

selection, and favour companies with healthy balance sheets,

good market positioning, decent earnings growth and are trading

at attractive valuations.

Client Services : 03-2778 1000 7

Eastspring Investments Dinasti Equity Fund

MANAGER’S REPORT (CONTINUED)

Asset Allocation 31-Dec 30-Jun

2019 2019

Asset Allocation Changes

(%) (%) (%)

Quoted Shariah

-compliant securities 97.10 95.01 2.09

2.90 4.99 (2.09)

Cash and other assets

Asset Allocation as at 31 December 2019

Cash and

other assets

2.90%

Quoted Shariah-

compliant securities

97.10%

There were no significant changes in asset allocation of the Fund

for the period under review.

8 Client Services : 03-2778 1000

Interim Report

MANAGER’S REPORT (CONTINUED)

State of Affairs of There have been neither significant change to the state of affairs of

the Fund the Fund nor any circumstances that materially affect any interests of

the unit holders during the period under review.

While in the Eastspring Investments Fourth Supplementary Master

Prospectus dated 1 August 2019, the information in relation to the

investmwtegy and the designated fund manager of the Fund have

been revised as set out in (a) and (b) below:

a. Investment Strategy

3rd paragraph:

The Fund shall invest in sukuk with a minimum credit rating

of AA3 or P2 by RAM, or its equivalent rating by any other

domestic rating agencies. Should the credit rating of the sukuk be

downgraded by the rating agencies to below the minimum credit

rating, the Manager may dispose of the affected sukuk in the

market.

5th paragraph:

The Fund will only invest in Shariah-compliant derivatives that

are issued by counterparties with a strong credit rating. The

counterparties must have a credit rating of at least AA3 or P2

by RAM, or its equivalent rating by any other domestic rating

agencies. Should the credit rating of the counterparty be

downgraded by the rating agencies to below the minimum credit

rating, the Manager will unwind the affected invested Shariah-

compliant derivative instrument or hold the Shariah-compliant

derivative instrument to maturity if its period to maturity is less

than six (6) months.

Client Services : 03-2778 1000 9

Eastspring Investments Dinasti Equity Fund

MANAGER’S REPORT (CONTINUED)

State of Affairs of b. EXTERNAL INVESTMENT MANAGER FOR THE EASTSPRING

the Fund INVESTMENTS DANA AL-ISLAH, EASTSPRING

(continued) INVESTMENTS DANA DINAMIK, EASTSPRING

INVESTMENTS DANA AL-ILHAM AND EASTSPRING

INVESTMENTS DINASTI EQUITY FUND

Roles and Duties of the External Investment Manager

The Manager has appointed Eastspring Al-Wara’ as the external

investment manager for Eastspring Investments Dana al-Islah,

Eastspring Investments Dana Dinamik, Eastspring Investments

Dana al-Ilham and Eastspring Investments Dinasti Equity Fund.

The External Investment Manager is responsible to invest the

investments of the above funds in accordance with the funds’

objective and its respective deeds, and subject to the Act, the

Guidelines and any practice notes issued by the SC from time

to time, as well as the internal policies and procedures of the

Manager. The External Investment Manager reports to the

investment committee of the above funds on a regular basis on

the status of the portfolio, proposed investment strategy and

other matters relating to the portfolio of the funds.

The External Investment Manager’s investment team is headed

by the chief investment officer. The chief investment officer is

supported by a team of experienced fund managers who are

responsible to manage the funds delegated to them.

10 Client Services : 03-2778 1000

Interim Report

MANAGER’S REPORT (CONTINUED)

State of Affairs of Tan Ming Han

the Fund Chief Investment Officer

(continued)

Tan Ming Han (Ming Han) joined Eastspring Al-Wara’ as

chief investment officer in November 2018. Prior to joining

Eastspring Al-Wara’, Ming Han was an associate director

in Amundi Malaysia Sdn Bhd where he managed regional

and domestic equity portfolios for institutional clients from

June 2012 to October 2018. Ming Han has past investment

experience in the industry including Meridian Asset

Management Sdn Bhd, HwangDBS Investment Management

and Philip Capital Management where he also managed both

local and regional unit trust funds and discretionary mandates.

He has long and short equity experience from his working stint

as a hedge fund manager in Singapore in 2010. He started

his career in corporate finance and brings with him more than

15 years of investment industry experience. Ming Han holds a

Bachelor of Commerce degree majoring in Corporate Finance

and International Business from the University of Adelaide,

Australia.

Client Services : 03-2778 1000 11

Eastspring Investments Dinasti Equity Fund

MARKET REVIEW

During the period under review, volatility was high throughout Greater China markets as

a series of events unfolded. The second half of 2019 started with social unrest in Hong

Kong, sparked by the Fugitive Offenders Bill tabled by the Hong Kong government. The

protests dragged on throughout the second half of 2019, causing tourism and retail sales

to slump and Hong Kong suffering its first recession since the global financial crisis. District

elections were also held in Hong Kong during the time, widely seen as a referendum to

the protests, which saw the pro-democracy party achieve its biggest win since history.

Meanwhile, trade friction between the United States (“US”) and China continued during

the half. More tariffs were imposed by the US on China, with USD 300billion worth of

Chinese imports slapped with fresh tariffs. However, financial markets later breathed a

sigh of relief after it was reported that the two countries were working towards a “Phase

1” deal that would avert further damage to both economies.

With manufacturing and private investments slowing due to uncertainty caused by

trade frictions, the Chinese government relaxed monetary policy by cutting reserve

requirements, lowering the lending rate, as well as loosening its fiscal purse to help

stimulate the economy. Policy help along with positive news flow surrounding the Phase 1

trade talks led to a rebound in financial markets.

Meanwhile, investors’ attention returned to the technology sector despite the World

Semiconductor Trade Statistics Organization projecting that global semiconductor sales

would decline 12.8% in 2019. The roll out of 5G networks in major cities in China and

the announcement of several 5G smartphone launches from major brands caused a stir

in the Greater China technology supply chains, with street analysts upgrading earnings

outlook for supply chain stocks into 2020.

Going forward, we expect trade tensions between the US and China to remain despite the

signing of a Phase 1 deal. We do see positives from the People’s Bank of China loosening

monetary policy and the Central government increasing the budget deficit to fiscally

stimulate the economy. Equity valuations now appear fair in Greater China stocks and over

the longer term we continue to look for companies entering the international markets or

playing more dominant roles in global supply chains, where we think the valuation gap is

likely to close in the long run.

12 Client Services : 03-2778 1000

Interim Report

REBATES AND SOFT COMMISSIONS

During the period under review, the Manager and its delegates (if any) did not receive any

soft commissions from stockbrokers.

Client Services : 03-2778 1000 13

Eastspring Investments Dinasti Equity Fund

This page is intentionally left blank.

14 Client Services : 03-2778 1000

Interim Report

EASTSPRING INVESTMENTS

DINASTI EQUITY FUND

UNAUDITED FINANCIAL STATEMENTS

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

Client Services : 03-2778 1000 15

Eastspring Investments Dinasti Equity Fund

STATEMENT BY THE MANAGER

We, Tang Chee Kin and Iskander Bin Ismail Mohamed Ali, being two of the Directors

of Eastspring Investments Berhad, do hereby state that, in the opinion of the Manager,

the accompanying unaudited financial statements set out on pages 19 to 68 are drawn

up in accordance with the provisions of the Deed and give a true and fair view of the

financial position of the Fund as at 31 December 2019 and of its financial performance,

changes in equity and cash flows for the six months financial period ended on that

date in accordance with the Malaysian Financial Reporting Standards and International

Financial Reporting Standards.

For and on behalf of the Manager,

EASTSPRING INVESTMENTS BERHAD

TANG CHEE KIN

Executive Director/Chief Executive Officer

ISKANDER BIN ISMAIL MOHAMED ALI

Independent, Non-Executive Director

Kuala Lumpur

Date: 17 February 2020

16 Client Services : 03-2778 1000

Interim Report

TRUSTEE’S REPORT TO THE UNIT HOLDERS OF

EASTSPRING INVESTMENTS DINASTI EQUITY FUND

We have acted as Trustee for Eastspring Investments Dinasti Equity Fund (the “Fund”)

for the financial period ended 31 December 2019. To the best of our knowledge, for

the financial period under review, Eastspring Investments Berhad (the “Manager”) has

operated and managed the Fund in accordance with the following:-

a. limitations imposed on the investment powers of the Manager under the Deed(s),

the Securities Commission’s Guidelines on Unit Trust Funds, the Capital Markets and

Services Act 2007 and other applicable laws;

b. valuation and pricing for the Fund is carried out in accordance with the Deed(s) of the

Fund and any regulatory requirements; and

c. creation and cancellation of units for the Fund are carried out in accordance with the

Deed(s) of the Fund and any regulatory requirements.

For Deutsche Trustees Malaysia Berhad

Ng Hon Leong Richard Lim Hock Seng

Head, Trustee Operations Chief Executive Officer

Kuala Lumpur

Date: 17 February 2020

Client Services : 03-2778 1000 17

Eastspring Investments Dinasti Equity Fund

SHARIAH ADVISER’S REPORT TO THE UNIT HOLDERS

OF EASTSPRING INVESTMENTS DINASTI EQUITY FUND

We have acted as the Shariah Adviser of Eastspring Investments Dinasti Equity Fund

(the “Fund”) managed by Eastspring Investment Berhad (“the Manager”) for the

financial period ended 31 December 2019.

Our responsibility is to ensure that the procedures and processes employed by the Manager

as well as the provisions of the Fund’s Deed dated 28 August 2009 and the Fourth

Supplemental Deed dated 11 December 2017 are all in accordance with Shariah principles.

In our opinion, based on the periodic reports submitted to us, the Manager has managed

and administered the Fund in accordance with Shariah principles and has complied with

applicable guidelines, rulings and decisions issued by the Shariah Advisory Council (“SAC”)

of the Securities Commission (“SC”) for the financial period ended 31 December 2019.

We confirm that the investment portfolio of the Fund comprises securities and instruments

which have been classified as Shariah-compliant by either the SAC of the SC, the SAC of

Bank Negara Malaysia (“BNM”) or the Shariah Supervisory Board of Dow Jones Islamic

Market Index (“SSB of DJIM”).

The exceptions are the securities of Real Gold Mining Ltd, China Petroleum & Chemical

Corporation and Petrochina Company Ltd which have been reclassified as Shariah non-

compliant by the SSB of DJIM. The securities of RGML were delisted from The Stock

Exchange of Hong Kong Limited effective 25 November 2019. These reclassified Shariah

non-compliant securities shall be disposed of according to the guidelines prescribed by the

SC.

As for securities and instruments which have not been classified by the SAC of the SC, the

SAC of BNM nor by the SSB of DJIM, we have reviewed and determined the Shariah status

of the said securities and instruments.

For and on behalf of Shariah Adviser,

BIMB SECURITIES SDN BHD

IR. DR. MUHAMAD FUAD ABDULLAH

Designated Shariah Person

Kuala Lumpur

Date: 17 February 2020

18 Client Services : 03-2778 1000

Interim Report

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

Note 6-months 6-months

financial financial

period period

ended ended

31.12.2019 31.12.2018

RM RM

INVESTMENT INCOME/(LOSS) 11,130,913 9,110,969

Gross dividend income

Profit income from Islamic deposits 55,502 509,300

with licensed financial institutions 6 100,905,170 (146,162,178)

Net gain/(loss) on financial assets at fair

(504,733) 425,040

value through profit or loss

Net foreign currency exchange (loss)/gain 111,586,852 (136,116,869)

EXPENSES 3 (7,802,030) (7,622,926)

Management fee

Custodian fee (231,636) (113,409)

Trustee fee

Audit fee 4 (346,757) (338,797)

Tax agent fee

Transaction cost (3,921) (3,932)

Other expenses

(1,709) (1,715)

PROFIT/(LOSS) BEFORE TAXATION

(1,997,139) (1,367,116)

TAXATION

(1,685,587) (57,419)

PROFIT/(LOSS) AFTER TAXATION AND

TOTAL COMPREHENSIVE PROFIT/(LOSS) (12,068,779) (9,505,314)

Profit/(loss) after taxation is made up of the 99,518,073 (145,622,183)

following:

Realised amount 5 - (1,159,844)

Unrealised amount

99,518,073 (146,782,027)

25,680,730 (30,565,117)

73,837,343 (116,216,910)

99,518,073 (146,782,027)

The accompanying summary of significant accounting policies and notes to the unaudited financial

statements form an integral part of these unaudited financial statements.

Client Services : 03-2778 1000 19

Eastspring Investments Dinasti Equity Fund

UNAUDITED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2019

Note 2019 2018

RM RM

ASSETS 8 34,282,512 82,869,290

Cash and cash equivalents

Dividends receivable 645,748 38,026

Amount due from Manager

Financial assets at fair value through 5,411,546 2,291,884

profit or loss 6 833,177,844 696,401,409

TOTAL ASSETS 873,517,650 781,600,609

LIABILITIES 2,830,789 -

Amount due to broker 10,919,022 1,517,878

Amount due to Manager

Amount due to custodian 310,029 67,917

Accrued management fee 1,315,606 1,223,770

Amount due to Trustee

Other payables and accruals 58,471 54,390

TOTAL LIABILITIES 26,916 43,657

15,460,833 2,907,612

NET ASSET VALUE OF THE FUND

858,056,817 778,692,997

EQUITY

Unit holders’ capital 800,461,915 907,041,492

Retained earnings/(accumulated losses) 57,594,902 (128,348,495)

NET ASSET ATTRIBUTABLE 858,056,817 778,692,997

TO UNIT HOLDERS

9 1,425,804,496 1,548,882,826

NUMBER OF UNITS IN CIRCULATION

0.6018 0.5027

NET ASSET VALUE PER UNIT (RM)

The accompanying summary of significant accounting policies and notes to the unaudited financial

statements form an integral part of these unaudited financial statements.

20 Client Services : 03-2778 1000

Interim Report

UNAUDITED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

Unit holders’ Retained Total

capital earnings/ RM

(accumulated

RM

losses)

RM

Balance as at 1 July 2019 903,517,514 (41,923,171) 861,594,343

Movement in unit holders’ 117,587,382 - 117,587,382

contribution: (220,642,981) - (220,642,981)

99,518,073 99,518,073

Creation of units from - 57,594,902 858,056,817

applications 800,461,915 18,433,532 840,542,481

822,108,949

Cancellation of units

Total comprehensive income 177,583,711 - 177,583,711

(92,651,168) - (92,651,168)

for the financial period

- (146,782,027) (146,782,027)

Balance as at 31 December 2019

907,041,492 (128,348,495) 778,692,997

Balance as at 1 July 2018

Movement in unit holders’

contribution:

Creation of units from

applications

Cancellation of units

Total comprehensive loss

for the financial period

Balance as at 31 December 2018

The accompanying summary of significant accounting policies and notes to the unaudited financial

statements form an integral part of these unaudited financial statements.

Client Services : 03-2778 1000 21

Eastspring Investments Dinasti Equity Fund

UNAUDITED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

Note 6-months 6-months

financial financial

period period

ended ended

31.12.2019 31.12.2018

RM RM

CASH FLOWS FROM OPERATING ACTIVITIES 411,089,314 232,798,762

Proceeds from sale of Shariah-compliant (326,107,847) (302,632,016)

investments 13,525,910 11,113,406

55,502 509,300

Purchase of Shariah-compliant investments

Dividends received (7,732,948) (7,664,766)

Profit income received from Islamic deposits (343,687) (340,656)

Management fee paid

Trustee fee paid (2,212,540) (1,506,000)

Payment for other fees and expenses (504,733) 425,040

Net foreign currency exchange (loss)/gain

87,768,971 (67,296,930)

Net cash generated from/(used in) operating

activities

CASH FLOWS FROM FINANCING ACTIVITIES 116,436,845 190,906,477

Cash proceeds from units created (217,452,251) (94,312,835)

Payments for cancellation of units

Distribution paid - (2,196,916)

Net cash (used in)/generated from financing (101,015,406) 94,396,726

activities

NET (DECREASE)/INCREASE (13,246,435) 27,099,796

IN CASH AND CASH EQUIVALENTS

CASH AND CASH EQUIVALENTS AT THE 47,528,947 55,769,494

BEGINNING OF THE FINANCIAL PERIOD

CASH AND CASH EQUIVALENTS AT THE 8 34,282,512 82,869,290

END OF THE FINANCIAL PERIOD

The accompanying summary of significant accounting policies and notes to the unaudited financial

statements form an integral part of these unaudited financial statements.

22 Client Services : 03-2778 1000

Interim Report

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

The following accounting policies have been used in dealing with items which are

considered material in relation to the financial statements.

A. BASIS OF PREPARATION OF THE FINANCIAL STATEMENTS

The financial statements have been prepared in accordance with the Malaysian

Financial Reporting Standards (“MFRS”) and International Financial Reporting

Standards (“IFRS”) under the historical cost convention, as modified by financial assets

at fair value through profit or loss.

The preparation of financial statements in conformity with the MFRS and IFRS

require the use of certain critical accounting estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements, and the reported amounts

of revenues and expenses during the reported financial period. It also requires the

Manager to exercise their judgment in the process of applying the Fund’s accounting

policies. Although these estimates and judgment are based on the Manager’s best

knowledge of current events and actions, actual results may differ.

The areas involving a higher degree of judgment or complexity, or areas where

assumptions and estimates are significant to the financial statements are disclosed in

Note L.

a. Standards, amendments to published standards and interpretations that are

effective:

The Fund has applied the following amendments for the first time for the

financial year beginning on 1 July 2019:

• Amendments to MFRS 112 ‘Income Taxes’ (effective from 1 January 2019)

clarify that where income tax consequences of dividends on financial

instruments classified as equity1 is recognised (either in profit or loss, other

comprehensive income or equity) depends on where the past transactions

that generated distributable profits were recognised.

¹ For the purposes of the investments made by the Fund, equity refers to Shariah-compliant equity

instruments.

Client Services : 03-2778 1000 23

Eastspring Investments Dinasti Equity Fund

Accordingly, the tax consequences are recognised in profit or loss when an

entity determines payments on such instruments are distribution of profits

(that is, dividends). Tax on dividend should not be recognised in equity1

merely on the basis that it is related to a distribution to owners.

This standard is not expected to have a significant impact on the Fund’s financial

statements.

B. INCOME RECOGNITION

Profit income from short-term Islamic deposits is recognised on an accrual basis using

the effective profit method.

Dividend income is recognised on the ex-dividend date, when the right to receive the

dividend has been established.

Realised gain or loss on sale of Shariah-compliant investments are accounted for as

the difference between the net disposal proceeds and the carrying amount of the

investments, determined on a weighted average cost basis.

C. TAXATION

Current tax expense is determined according to Malaysian tax laws at the current rate

based upon the taxable profit earned during the financial period.

Tax on dividend income from foreign quoted Shariah-compliant securities is based on

the tax regime of the respective countries that the Fund invests in.

D. FUNCTIONAL AND PRESENTATION CURRENCY

Items included in the financial statements of the Fund are measured using the

currency of the primary economic environment in which the Fund operates (the

“functional currency”). The financial statements are presented in Ringgit Malaysia

(“RM”), which is the Fund’s functional and presentation currency.

24 Client Services : 03-2778 1000

Interim Report

E. FOREIGN CURRENCY TRANSLATION

Foreign currency transactions in the Fund are translated into the functional currency

using the exchange rates prevailing at the transaction dates. Foreign exchange gains

and losses resulting from the settlement of such transactions and from the translation

at year-end exchange rates of monetary assets and liabilities denominated in foreign

currencies are recognised in the statement of comprehensive income, except when

deferred in other comprehensive income as qualifying cash flow hedges.

F. FINANCIAL ASSETS AND FINANCIAL LIABILITIES

i. Classification

The Fund classify its financial assets in the following measurement categories:

• those to be measured subsequently at fair value (either through other

comprehensive income (“OCI”) or through profit or loss), and

• those to be measured at amortised cost

The Fund classifies its Shariah-compliant investments based on both the Fund’s

business model for managing those financial assets and the contractual cash

flow characteristics of the financial assets. The portfolio of financial assets

is managed and performance is evaluated on a fair value basis. The Fund is

primarily focused on fair value information and uses that information to assess

the assets’ performance and to make decisions. The Fund has not taken the

option to irrevocably designate any equity1 securities as fair value through other

comprehensive income. Consequently, all Shariah-compliant investments are

measured at fair value through profit or loss.

The Fund classifies cash and cash equivalents, dividends receivable and amount

due from Manager as financial assets at amortised cost as these financial assets

are held to collect contractual cash flows consisting of the amount outstanding.

The Fund classifies accrued management fee, amount due to Manager, amount

due to broker, amount due to custodian, amount due to Trustee and other

payables and accruals as financial liabilities measured at amortised cost.

¹ For the purposes of the investments made by the Fund, equity refers to Shariah-compliant equity

instruments.

Client Services : 03-2778 1000 25

Eastspring Investments Dinasti Equity Fund

ii. Recognition and measurement

Regular purchases and sales of financial assets are recognised on the trade date,

the date on which the Fund commits to purchase or sell the asset. Shariah-

compliant investments are initially recognised at fair value and transaction costs

are expensed in the statement of comprehensive income.

Financial assets are derecognised when the rights to receive cash flows from the

Shariah-compliant investments have expired or have been transferred and the

Fund has transferred substantially all risks and rewards of ownership.

Financial liabilities are recognised in the statement of financial position when, and

only when, the Fund becomes a party to the contractual provisions of the financial

instrument.

Financial liability is derecognised when the obligation under the liability is

extinguished; i.e when the obligation specified in the contract is discharged or

cancelled or expired.

Unrealised gains or losses arising from changes in the fair value of the ‘financial

assets at fair value through profit or loss including the effects of currency

translation, are presented in the statement of comprehensive income within ‘net

gain/(loss) on financial assets at fair value through profit or loss’ in the financial

period in which they arise. Any unrealised gains however are not distributable.

Dividend income from financial assets at fair value through profit or loss is

recognised in the statement of comprehensive income as part of gross dividend

income when the Fund’s right to receive payments is established.

Quoted Shariah-compliant securities outside Malaysia are valued at the last traded

market price quoted on the respective foreign stock exchanges at the close of the

business day.

If a valuation based on the market price does not represent the fair value of the

Shariah-compliant securities, for example during abnormal market conditions or

when no market price is available, including in the event of a suspension in the

quotation of the Shariah-compliant securities for a period exceeding 14 days,

26 Client Services : 03-2778 1000

Interim Report

or such shorter period as agreed by the Trustee, then the Shariah-compliant

securities are valued as determined in good faith by the Manager, based on the

methods or basis approved by the Trustee after appropriate technical consultation.

Islamic deposits with licensed financial institutions are stated at cost plus accrued

profit rate calculated on the effective profit rate method over the period from the

date of placement to the date of maturity of the respective Islamic deposits.

Receivables and other financial liabilities are subsequently carried at amortised

cost using the effective profit rate method.

iii. Impairment for assets carried at amortised costs

For assets carried at amortised cost, the Fund assesses at the end of the financial

period whether there is objective evidence that a financial asset or group of

financial assets is impaired. A financial asset is a group of financial assets are

impaired and impairment losses are incurred only if there is objective evidence

of impairment as a result of one or more events that occurred after the initial

recognition of the asset (a ‘loss event’) and that loss event (or events) has an

impact on the estimated future cash flows of the financial asset or group of

financial assets that can be reliably estimated.

The amount of the loss is measured as the difference between the asset’s carrying

amount and the present value of estimated future cash flows (excluding future

credit losses that have not been incurred) discounted at the financial asset’s

original effective profit rate. The asset’s carrying amount is reduced and the

amount of the loss is recognised in the statement of comprehensive income.

If ‘receivables’ have a variable profit rate, the discount rate for measuring any

impairment loss is the current effective profit rate determined under the contract.

As a practical expedient, the Fund may measure impairment on the basis of an

instrument’s fair value using an observable market price.

If, in a subsequent period, the amount of the impairment loss decreases and the

decrease can be related objectively to an event occurring after the impairment

was recognised (such as an improvement in the obligor’s credit rating), the

reversal of the previously recognised impairment loss is recognised in the

statement of comprehensive income.

Client Services : 03-2778 1000 27

Eastspring Investments Dinasti Equity Fund

When an asset is uncollectible, it is written off against the related allowance

account. Such assets are written off after all the necessary procedures have been

completed and the amount of the loss has been determined.

The Fund measures credit risk and expected credit losses using probability of

default, exposure at default and loss given default. Management considers both

historical analysis and forward looking information in determining any expected

credit loss. Management considers the probability of default to be close to zero as

these instruments have a low risk of default and the counterparties have a strong

capacity to meet their contractual obligations in the near term. As a result, no loss

allowance has been recognised based on 12 months expected credit losses as any

such impairment would be wholly insignificant to the Fund.

Significant increase in credit risk

A significant increase in credit risk is defined by management as any contractual

payment which is more than 30 days past due.

Definition of default and credit-impaired financial assets

Any contractual payment which is more than 90 days past due is considered credit

impaired.

Write-off

The Fund writes off financial assets, in whole or in part, when it has exhausted

all practical recovery efforts and has concluded that there is no reasonable

expectation of recovery. The assessment of no reasonable expectation of recovery

is based on unavailability of obligor’s sources of income or assets to generate

sufficient future cash flows to pay the amount. The Fund may write-off financial

assets that are still subject to enforcement activity. Subsequent recoveries of

amounts previously written off will result in impairment gains. There are no write-

offs/recoveries during the financial period.

28 Client Services : 03-2778 1000

Interim Report

G. CASH AND CASH EQUIVALENTS

For the purpose of the statement of cash flows, cash and cash equivalents

comprise Islamic deposit with a licensed financial institution and bank balances

that are readily convertible to known amounts of cash and which are subject to an

insignificant risk of changes in value.

H. TRANSACTION COSTS

Transaction costs are costs incurred to acquire financial assets or liabilities at fair

value through profit or loss. They include the bid-ask spread, fees and commissions

paid to agents, advisors, brokers and dealers. Transaction costs, when incurred, are

immediately recognised in the statement of comprehensive income as expenses.

I. UNIT HOLDERS’ CAPITAL

The unit holders’ contributions to the Fund meet the criteria to be classified as equity

instruments under MFRS 132 “Financial Instruments: Presentation”. Those criteria

include:

• the units entitle the holder to a proportionate share of the Fund’s net assets value;

• the units are the most subordinated class and class features are identical;

• t here is no contractual obligations to deliver cash or another financial asset other

than the obligation on the Fund to repurchase; and

• the total expected cash flows from the units over its life are based substantially on

the profit or loss of the Fund.

The outstanding units are carried at the redemption amount that is payable at each

financial year if unit holder exercises the right to put the unit back to the Fund.

Units are created and cancelled at prices based on the Fund’s net asset value per unit

at the time of creation or cancellation. The Fund’s net asset value per unit is calculated

by dividing the net assets attributable to unit holders with the total number of

outstanding units.

Client Services : 03-2778 1000 29

Eastspring Investments Dinasti Equity Fund

J. AMOUNTS DUE FROM/(TO) BROKERS

Amounts due from and to brokers represent receivables for Shariah-compliant

securities sold and payables for Shariah-compliant securities purchased that have been

contracted for but not yet settled or delivered on the statement of financial position

date respectively. The amount due from brokers balance is held for collection.

These amounts are recognised initially at fair value and subsequently measured at

amortised cost. At each reporting date, the Fund shall measure the loss allowance

on amounts due from broker at an amount equal to the lifetime expected credit

losses if the credit risk has increased significantly since initial recognition. If, at the

reporting date, the credit risk has not increased significantly since initial recognition,

the Fund shall measure the loss allowance at an amount equal to 12-months expected

credit losses. Significant financial difficulties of the broker, probability that the broker

will enter bankruptcy or financial reorganisation, and default in payments are all

considered indicators that a loss allowance may be required.

If the credit risk increases to the point that it is considered to be credit impaired,

profit income will be calculated based on the gross carrying amount adjusted for the

loss allowance. A significant increase in credit risk is defined by management as any

contractual payment which is more than 30 days past due.

Any contractual payment which is more than 90 days past due is considered credit

impaired.

K. FAIR VALUE OF FINANCIAL INSTRUMENTS

Shariah-compliant financial instruments comprise financial assets and financial

liabilities. Fair value is defined as the price that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants at the

measurement date (i.e. an exit price). The information presented herein represents the

estimates of fair values as on the statement of financial position date.

30 Client Services : 03-2778 1000

Interim Report

L. CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS IN APPLYING

ACCOUNTING POLICIES

The Fund makes estimates and assumptions concerning the future. The resulting

accounting estimates will, by definition, rarely equal the related actual results. To

enhance the information contents on the estimates, certain key variables that are

anticipated to have material impacts to the Fund’s results and financial position are

tested for sensitivity to changes in the underlying parameters.

Estimates and judgments are continually evaluated by the Manager and the Trustee

and are based on historical experience and other factors, including expectations of

future events that are believed to be reasonable under the circumstances.

In undertaking any of the Fund’s Shariah-compliant investment, the Manager will

ensure that all assets of the Fund under management will be valued appropriately, that

is at fair value and in compliance with Securities Commission Guidelines on Unit Trust

Funds.

However, the Manager is of the opinion that in applying the accounting policies, no

significant judgment was required.

Client Services : 03-2778 1000 31

Eastspring Investments Dinasti Equity Fund

NOTES TO THE UNAUDITED FINANCIAL STATEMENTS

FOR THE SIX MONTHS FINANCIAL PERIOD ENDED 31 DECEMBER 2019

1. INFORMATION ON THE FUND

The Unit Trust Fund (the “Fund”) was constituted under the name Eastspring

Investments Dinasti Equity Fund pursuant to the execution of a Deed dated

28 August 2009 (the “Deed”) entered into between Eastspring Investments Berhad

(the “Manager”) and Deutsche Trustees Malaysia Berhad (the “Trustee”), followed

by Supplemental Deed dated 20 January 2012, Second Supplemental Deed dated 26

March 2014, Third Supplemental Deed dated 2 January 2015 and Fourth Supplemental

Deed dated 11 December 2017 (collectively referred to as the “Deed”).

The Fund was launched on 26 October 2009 and will continue its operations until

terminated by the Trustee or the Manager as provided under Part 12 of the Deed.

The Fund invests primarily in Shariah-compliant equities and Shariah-compliant equity-

related securities of companies based in the Greater China region which potentially

offer attractive long-term value. These include Shariah-compliant securities of Greater

China-based companies listed or to be listed on recognised exchanges of the People’s

Republic of China, Hong Kong and Taiwan as well as other recognised exchanges such

as in Malaysia, Singapore and United States of America where the regulatory authority

is a member of the International Organization of Securities Commissions (“IOSCO”). All

investments will be subjected to the Securities Commissions (“SC”) Guidelines on Unit

Trust Funds, the Deed and the objective of the Fund.

The main objective of the Fund is to provide investors with long-term capital

appreciation by investing in Shariah-compliant investments with exposure to the Greater

China Region.

The Manager is a company incorporated in Malaysia and is related to Prudential Plc., a

public listed company in the United Kingdom. The principal activity of the Manager is

the establishment and management of unit trust funds and asset management.

32 Client Services : 03-2778 1000

Interim Report

2. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The Fund is exposed to a variety of risks which include market risk (inclusive of

price risk, exposure to interest rate risk and foreign exchange/currency risk), fund

management risk, capital risk, credit/default risk, liquidity risk and Shariah status

reclassification risk.

Financial risk management is carried out through internal control processes adopted

by the Manager and adherence to the investment restrictions as stipulated in the

Deed.

Financial instruments of the Fund are as follows:

Note Financial Financial Total

8 assets at assets at fair RM

6 amortised value through

profit or loss

cost

RM

RM

2019 34,282,512 - 34,282,512

Cash and cash equivalents 5,411,546 - 5,411,546

Amount due from 645,748 - 645,748

Manager - 833,177,844 833,177,844

Dividends receivable 40,339,806 833,177,844 873,517,650

Quoted Shariah-compliant

securities

Client Services : 03-2778 1000 33

Eastspring Investments Dinasti Equity Fund

Note Receivables Financial Total

RM assets at fair RM

value through

profit or loss

RM

2018

Cash and cash equivalents 8 82,869,290 - 82,869,290

Amount due from 2,291,884 - 2,291,884

Manager

Dividends receivable 38,026 - 38,026

Quoted Shariah-compliant 6 - 696,401,409 696,401,409

securities

85,199,200 696,401,409 781,600,609

All liabilities are financial liabilities which are carried at amortised cost.

Market risk

i. Price risk

This risk refers to changes and developments in regulations, politics and the

economy of the country. The very nature of an Islamic Unit Trust Fund, however,

helps mitigate this risk because a fund would generally hold a well-diversified

portfolio of Shariah-compliant securities from different market sectors so that the

collapse of any one Shariah-compliant security or any one market sector would

not impact too greatly on the value of the fund.

34 Client Services : 03-2778 1000

Interim Report

The table below shows assets of the Fund as at 31 December which are exposed

to price risk:

2019 2018

RM RM

Quoted Shariah-compliant securities 833,177,844 696,401,409

designated at fair value through profit or loss

The following table summarises the sensitivity of the Fund’s net asset value

and profit/(loss) after tax to movements in prices of quoted Shariah-compliant

securities at the end of the reporting period. The analysis is based on the

assumptions that the market price of the quoted Shariah-compliant securities

increased by 5% and decreased by 5% with all other variables held constant.

This represents management’s best estimate of a reasonable possible shift in the

quoted Shariah-compliant securities, having regard to the historical volatility of

the prices.

% Change in price Market Impact on profit/

value (loss) after tax and

2019

+5% RM net asset value

-5%

RM

2018

+5% 874,836,736 41,658,892

-5% 791,518,952 (41,658,892)

731,221,479 34,820,070

661,581,339 (34,820,070)

Client Services : 03-2778 1000 35

Eastspring Investments Dinasti Equity Fund

ii. Exposure to interest rate risk

Fair value interest rate risk is the risk that the value of a financial instrument will

fluctuate due to changes in market interest rates.

Interest rate is a general economic indicator that will have an impact on the

management of the Fund regardless whether it is an Islamic Unit Trust Fund or

otherwise. It does not in any way suggest that the Fund will invest in conventional

financial instruments. All the investments are carried out for the Fund are in

accordance with Shariah requirements.

As at the date of the statement of financial position, all the financial assets and

financial liabilities have no exposure to interest rate movement except for Islamic

deposits with licensed financial institution of Nil (2018: RM25,051,151) which

have maturities of less than one year.

The Fund’s investments in Islamic deposits with licensed financial institutions are

short term in nature. Therefore, exposure to interest rate fluctuations is minimal.

The Fund is not exposed to cash flow interest rate risk as the Fund does not hold

any financial instruments at variable profit rate.

iii. Foreign exchange/Currency risk

As the Fund may invest its assets in Shariah-compliant securities denominated

in a wide range of currencies other than Ringgit Malaysia, the NAV of the Fund

expressed in Ringgit Malaysia may be affected favourably or unfavourably by

exchange control regulations or changes in the exchange rates between Ringgit

Malaysia and such other currencies. The risk is minimised through investing in a

wide range of foreign currencies denominated assets and thus, diversifying the

risk of single currency exposure.

In the normal course of investment, the Manager will usually not hedge foreign

currency exposure. The Manager may however, depending on prevailing market

circumstances at a particular point in time, choose to use Islamic forward or

Islamic option contracts for hedging and risk reduction purposes.

36 Client Services : 03-2778 1000

Interim Report

The following table sets out the foreign exchange/currency risk concentrations

and counterparties of the Fund.

Financial Cash Dividends Total

assets at and cash receivable RM

fair value equivalents

through RM

profit or loss RM

RM

2019 419,522,832 - 38,397 419,561,229

186,142,238 34,052,804 - 220,195,042

HKD 227,512,774 228,120,125

USD 833,177,844 - 607,351 867,876,396

TWD 34,052,804 645,748

Financial Cash Dividends Total

assets at and cash receivable RM

fair value equivalents

through RM

profit or loss RM

RM

2018 397,894,311 - 38,597 397,932,908

128,396,039 46,050,810 - 174,446,849

HKD 170,111,059 - 170,111,059

USD 696,401,409 - 742,490,816

TWD 46,050,810 38,597

Client Services : 03-2778 1000 37

Eastspring Investments Dinasti Equity Fund

The table below summarises the sensitivity of the Fund’s financial assets fair value

to changes in foreign exchange movements at the end of the reporting period.

The analysis is based on the assumption that the foreign exchange rate changes

by 5% with all variables remain constant. This represents management’s best

estimate of a reasonable possible shift in the foreign exchange rate having regard

to historical volatility of this rate.

Disclosures below are shown in absolute terms, changes and impacts could be

positive or negative.

Change in Impact on Impact on

price profit/(loss) net asset

% after tax value

RM

RM

20,978,061

2019 5 20,978,061 11,009,752

5 11,009,752 11,406,006

HKD 5 11,406,006

USD

TWD 5 19,896,645 19,896,645

5 8,722,342 8,722,342

2018 5 8,505,553 8,505,553

HKD

USD

TWD

38 Client Services : 03-2778 1000

Interim Report

Fund management risk

There is the risk that the management company may not adhere to the investment

mandate of the respective Fund. With close monitoring by the investment committee,

back office system being incorporated with limits and controls, and regular reporting

to the senior management team, the management company is able to manage such

risk. The Trustee has an oversight function over management of the Fund by the

management company to safeguard the profit of unit holders.

Capital risk

The capital of the Fund is represented by equity consisting of unit holders’ capital

of RM800,461,915 (2018: RM907,041,492) and retained earnings/(accumulated

losses) of RM57,594,902 (2018: (RM128,348,495)). The amount of equity can

change significantly on a daily basis as the Fund is subject to daily subscriptions and

redemptions at the discretion of unit holders. The Fund’s objective when managing

capital is to safeguard the Fund’s ability to continue as a going concern in order to

provide returns for unit holders and benefits for other stakeholders and to maintain a

strong capital base to support the development of the Shariah-compliant investment

activities of the Fund.

Credit/Default risk

Credit risk refers to the ability of an issuer or a counter party to make timely payments

of profit, principals and proceeds from realisation of investments.

For amount due from brokers, the settlement terms are governed by the relevant rules

and regulations as prescribed by respective stock exchange.

The credit/default risk is minimal as all transactions in quoted Shariah-compliant

securities are settled/paid upon delivery using approved brokers. The credit risk arising

from placements of Islamic deposits in licensed financial institutions is managed by

ensuring that the Fund will only place Islamic deposits in reputable licensed financial

institutions. The settlement terms of the proceeds from the creation of units receivable

from the Manager are governed by the SC’s Guidelines on Unit Trust Funds.

Client Services : 03-2778 1000 39

Eastspring Investments Dinasti Equity Fund

The following table sets out the credit risk concentrations and counterparties of the

Fund:

Cash and cash Amount Dividends Total

equivalents due from receivable RM

Manager

RM RM

RM

2019 34,282,512 - - 34,282,512

Finance - - 38,397 38,397

- AA1

Industrial - - 607,351 607,351

- NR

Technology - 5,411,546 - 5,411,546

- NR 34,282,512 5,411,546 645,748 40,339,806

Other

- NR 5,000,467 - - 5,000,467

57,818,139 - - 57,818,139

2018 20,050,684 - - 20,050,684

Finance - - 38,026 38,026

- AAA

- AA1 - 2,291,884 - 2,291,884

- AA2 82,869,290 2,291,884 38,026 85,199,200

Industrial

- NR

Other

- NR

None of these assets are past due or impaired.

40 Client Services : 03-2778 1000

Interim Report

Liquidity risk

Liquidity risk is the risk that the Fund will encounter difficulty in meeting its financial

obligations. Generally, all investments are subject to a certain degree of liquidity risk

depending on the nature of the investment instruments, market, sector and other

factors. For the purpose of the Fund, the Manager will attempt to balance the entire

portfolio by investing in a mix of assets with satisfactory trading volume and those

that occasionally could encounter poor liquidity. This is expected to reduce the risks for

the entire portfolio without limiting the Fund’s growth potentials.

The Fund maintains sufficient level of Islamic liquid assets, after consultation with

the Trustee, to meet anticipated payments and cancellations of units by unit holders.

Islamic liquid assets comprise cash, Islamic deposits with licensed financial institutions

and other instruments which are capable of being converted into cash within 7 days.

Client Services : 03-2778 1000 41

Eastspring Investments Dinasti Equity Fund

The table below summarises the Fund’s financial liabilities into relevant maturity

groupings based on the remaining period as at the statement of financial position

date to the contractual maturity date. The amounts in the table are the contractual

undiscounted cash flows.

Less than Between Total

1 month 1 month RM

to 1 year

RM

RM

10,919,022

2019 2,830,789 - 10,919,022

Amount due to Manager 1,315,606 - 2,830,789

Amount due to broker 58,471 - 1,315,606

Accrued management fee 310,029 - 58,471

Amount due to Trustee - - 310,029

Amount due to custodian 26,916 26,916

Other payables and accruals 15,433,917 26,916

Contractual cash outflows 15,460,833

2018 1,517,878 - 1,517,878

Amount due to Manager 1,223,770 - 1,223,770

Accrued management fee -

Amount due to Trustee 54,390 - 54,390

Amount due to custodian 67,917 43,657 67,917

Other payables and accruals 43,657 43,657

Contractual cash outflows - 2,907,612

2,863,955

42 Client Services : 03-2778 1000

Interim Report

Shariah Status Reclassification risk

The risk that the currently held Shariah-compliant equity securities in the portfolio

of Islamic funds may be reclassified as Shariah non-compliant in the periodic review

of the securities by the Shariah Advisory Council of the Securities Commission, the

Shariah Adviser or the Shariah Supervisory Boards of relevant Islamic indices. If this

occurs, the Manager will take the necessary steps to dispose of such securities.

Opportunity loss could occur due to the restriction on the Fund to retain the excess

capital gains derived from the disposal of the reclassified Shariah non-compliant

securities. In such an event, the Fund is required:

i. to dispose such securities with immediate effect or within one (1) calendar

month if the value of the securities exceeds or is equal to the investment cost on

the effective date of Reclassification of the List of Shariah-compliant securities

(“Reclassification“) by the SAC of the SC, the Shariah Adviser or the Shariah

Supervisory Boards of relevant Islamic indices. The Fund is allowed to keep

dividends received and capital gains from the disposal of the securities up to the

effective date of Reclassification. However, any dividends received and excess

capital gains from the disposal of the Shariah non-compliant securities after

the effective date of Reclassification should be channelled to baitulmal and/or

approved charitable bodies;

ii. to hold such securities if the value of the said securities is below the investment

cost on the effective date of Reclassification until the total subsequent dividends

received (if any) and the market price of the securities is equal to the cost of

investment at which time disposal has to take place within one (1) calendar

month, capital gains (if any) from the disposal of the securities should be

channelled to baitulmal and/or approved charitable bodies; or

iii. to dispose such securities at a price lower than the investment cost which will

result in a decrease in the Fund’s value.

Client Services : 03-2778 1000 43

Eastspring Investments Dinasti Equity Fund

Fair value estimation

Fair value is defined as the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants at the

measurement date (i.e. an exit price).

The fair value of financial assets traded in active market (such as trading Shariah-

compliant securities) are based on quoted market prices at the close of trading on

the period end date. The Fund utilises the last traded market price for financial assets

where the last traded price falls within the bid-ask spread. In circumstances where

the last traded price is not within the bid-ask spread, the Manager will determine the

point within the bid-ask spread that is representative of the fair value.

An active market is a market in which transactions for the asset take place with

sufficient frequency and volume to provide pricing information on an ongoing basis.

The fair value of financial assets that are not traded in an active market is determined

by using valuation techniques.

Fair value hierarchy

i. The table below analyses financial instruments carried at fair value by valuation

method. The different levels have been defined as follows:

• Level 1: Quoted prices (unadjusted) in active market for identical assets or

liabilities.

• Level 2: Inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (that is, as prices) or

indirectly (that is, derived from prices).

• Level 3: Inputs for the asset and liability that are not based on observable

market data (that is, unobservable inputs).

The level in the fair value hierarchy within which the fair value measurement is

categorised in its entirety is determined on the basis of the lowest level input that

is significant to the fair value measurement in its entirety. For this purpose, the

significance of an input is assessed against the fair value measurement in its entirety.

If a fair value measurement uses observable inputs that require significant adjustment

based on unobservable inputs, that measurement is a level 3 measurement.

44 Client Services : 03-2778 1000

Interim Report

Assessing the significance of a particular input to the fair value measurement in its

entirety requires judgement, considering factors specific to the asset or liability.

The determination of what constitutes ‘observable’ requires significant judgment by

the Fund. The Fund considers observable data to be that market data that is readily

available, regularly distributed or updated, reliable and verifiable, not proprietary, and

provided by independent sources that are actively involved in the relevant market.

The following table analyses within the fair value hierarchy the Fund’s financial

assets (by class) measured at fair value:

Level 1 Level 2 Level 3 Total

RM RM RM RM

2019 833,177,844 - - 833,177,844

Financial assets at fair value

through profit or loss:

Quoted Shariah

-compliant securities

2018

Financial assets at fair value

through profit or loss:

Quoted Shariah

-compliant securities 696,401,409 - - 696,401,409

Investments whose values are based on quoted market prices in active markets,

and are therefore classified within Level 1, include active quoted Shariah-

compliant securities. The Fund does not adjust the quoted prices for these

instruments. The Fund’s policies on valuation of these financial assets are stated in

Note F to the financial statements.

ii. The carrying value of cash and cash equivalents, dividends receivable, amount due

from Manager and all liabilities are a reasonable approximation of their fair values

due to their short term nature.

Client Services : 03-2778 1000 45

Eastspring Investments Dinasti Equity Fund

3. MANAGEMENT FEE

In accordance with the Deed, the Manager is entitled to a management fee at a rate

not exceeding 2.00% per annum of the net asset value of the Fund accrued and

calculated on daily basis.

For the financial period ended 31 December 2019, the management fee is recognised

at a rate of 1.80% (2018: 1.80%) per annum of the net asset value of the Fund,

calculated on daily basis.

There will be no further liability to the Manager in respect of the management fee

other than the amounts recognised above.

4. TRUSTEE FEE

In accordance with the Deed, the Trustee is entitled to an annual fee at a rate not

exceeding 0.20% per annum of the net asset value of the Fund, subject to a minimum

fee of RM18,000 per annum (excluding foreign custodian fees and charges).

For the financial period ended 31 December 2019, the Trustee fee is recognised at a

rate of 0.08% (2018: 0.08%) per annum of the net asset value of the Fund, subject to

a minimum fee of RM18,000 per annum inclusive of local custodian fee, calculated on

daily basis.

There will be no further liability to the Trustee in respect of the trustee fee other than

the amounts recognised above.

46 Client Services : 03-2778 1000

The words you are searching are inside this book. To get more targeted content, please make full-text search by clicking here.

Interim Report for the Six Months Financial Period Ended 31 December 2019

Discover the best professional documents and content resources in AnyFlip Document Base.

Search