MINING FUND FOCUS INVEST DIY

THE UN CLIMATE IS OFFSHORE FUND TIPS TO MANAGE

FOCUS REAL-WORLD

REPORT’S IMPACT ON BECOMING MARKET FEARS

YOUR QUARTERLY

SA COAL MINERS OVERVALUED? REVIEW OF SA FUNDS FIND US AT:

fin24.com/finweek

SEPTEMBER 2021

LOOKING FOR

RETURNS

AS OFFSHORE ASSETS

BECOME EXPENSIVE

ENGLISH EDITION

10 September - 23 September 2021 EVERY TWO WEEKS

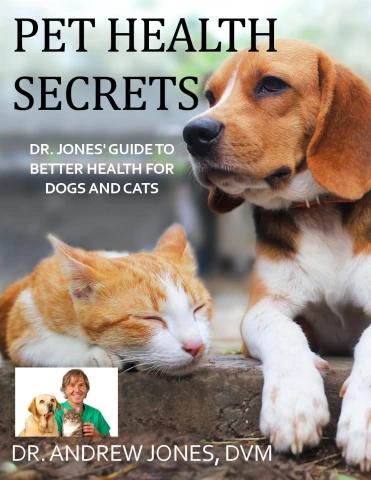

FOOD IS

GETTING MORE

EXPENSIVE

HOW SA’S FOOD

COMPANIES ARE +SHARE VIEWS ON:

TIGER BRANDS

COPING RCL FOODS

AVI

ASTRAL FOODS

36201

SA: R 42.00 (incl. VAT) 9 771024 740005 SPOTLIGHT: OMNIA’S CEO ON HOW TO TURN A COMPANY AROUND

NAMIBIA: N$ 42.00

from the editor contents

JACO VISSER Opinion

l ud opposition was voiced during the past couple of weeks following the 5 Insuring like it’s the future

overnment’s publication of a green paper (basically a pre-policy document to test

e waters) calling for mandatory social security deductions from all taxpayers. In brief

The 89-page document, released on 18 August, calls for the creation of a National

Social Security Fund with employer and employee contributions ranging between 6 News in numbers

8% and 12% of earnings up to an earnings ceiling of R276 000 per year. The public 8 ‘Pulling all stops’ on climate change

would’ve had until 10 December to voice their views on this. However, the outcry 9 Value over volume?

against the proposal was so loud that the minister of social development, Lindiwe 10 A review of SA’s venture capital and

Zulu, pulled it by the end of the month.

But is a universal social security “tax” or contribution new? In Namibia, for private equity classes

example, employees and employers contribute a total of 1.8% of earnings with a

minimum monthly contribution of N$2.70 and a maximum of N$81 each to the Marketplace

Social Security Commission. This entity – which can be equated to a mix between

the functions of the Unemployment Insurance Fund and the Compensation Fund – 11 Fund in Focus: PortfolioMetrix BCI

pays maternity, disability, death, funeral cover and even study bursaries and loans to SA Equity Fund

Namibians (according to the commission’s requirements).

In the UK, National Insurance is levied on all employed people earning more than 12 House View: Merafe Resources,

£184 per week and all self-employed people making an annual profit exceeding Sibanye-Stillwater

£6 515. These contributions to National Insurance entitle contributors to the state

pension, jobseeker’s allowance, maternity allowance and bereavement support. For 13 Killer Trade: Shoprite

those in employment, the contribution rate is 12% on a monthly income between 14 Invest DIY: How to use net asset

£797 and £4 189 (R15 905 and R83 597) and 2% on earnings above £4 189 per

month. The new state pension, introduced in April 2016, pays a weekly amount of value when considering stocks

£179.60 (£778 or R15 526 per month) to eligible retirees (who have contributed for 15 Investment: Relativity in the

at least 10 years to National Insurance or have credits to their benefit).

Back home now. Minister Zulu’s proposal – which could have seen the investment world

consolidation of the UIF, Compensation Fund and Road Accident Fund into a single 16 Share View: Pandemics, politics,

entity – drew more than 17 000 inputs from South Africans in less than two weeks.

Almost all of them against the proposal. conspiracy theories – what’s next?

The question is why? My two cents’ worth explanation would be that ordinary 17 Invest DIY: Managing real-world

South Africans are distrustful of the government and its priorities. When a

government proposes a society-wide modification, it needs the buy-in of the people market fears

it governs. It cannot rule from the top down. Those days in SA are long over where a 18 Simon Says: ARB Holdings, coal

concentrated “power class” dictates to its citizens, from whence it draws its power,

what is “good for them”. Add to that the miserable fact that out of 60.1m people in SA miners, Curro, Massmart, Metair,

only 14.9m are employed (of which 10.2m in the formal sector where SARS can know Naspers, Purple Group, Sasol,

about earnings that could be taxed), the backlash should not have come as a surprise. Sibanye-Stillwater

These figures are from the latest Stats SA data on unemployment. 20 Investment: PMI data: An early

Thus, it boils down to priorities. Some 34.5m South Africans are aged between warning

20 and 64 years, according to Stats SA’s latest mid-year population estimate. We can

think of these as the true working-age population. (I honestly don’t understand or Fund Focus

agree why those between 15 and 18 are also classified as working age.) Of these, less

than a third are employed. This should be any caring and responsible government’s 21 Looking for returns as offshore

main priority: How do we get 19.6m South Africans into jobs? And rather soon. assets become expensive

I would venture to say that the proposed National Social Security Fund and even

the National Health Insurance are not bad ideas and could benefit the people of this Cover

country. But it needs to be affordable. The contributors to these two social security

systems need to be as many as possible. Isn’t that the whole idea with insurance? A 30 There’s (always) money in food

large pool of contributors? And the only way we can reach affordability is if another

19.6m people enter employment. On the money

The ways in which the government can achieve rapid job creation are well-

documented, debated, pleaded and proposed in this country. All that is now needed 38 Spotlight: A great story to tell

is reprioritisation and a sense of caring for those without an income to fulfil their and 40 Business: The future of accounting:

their loved ones’ most basic needs. ■

co-habitation with bots

4 finweek 10 September 2021 42 Motoring: More than a little electric

44 Personal Finance: Balance your

lifestyle with a retirement portfolio

46 Piker, quiz and crossword

www.fin24.com/finweek

opinion

By Johan Fourie

TECHNOLOGY

Insuring like it’s the future

t The shift to digital has fast-tracked both the demand for and supply of new kinds of insurance services.

he days of a man in an oversized, dreary grey suit, instant cashback each month when you drive under

sitting at his desk in a smoke-filled office selling 300km. During level-5 lockdown people’s time on the road

stock-standard insurance policies are long gone. decreased by 74% and driving between 00:00 and 05:00

Insurance is now the sexiest industry on the block. – which historically is considered dangerous – dropped by

Just ask those who head up the Naspers* Foundry, which a further 81%. We want our members to benefit without

in early August announced another investment in the putting the onus or risk on them to report when they are

insurtech space: R120m into Naked, an AI-driven insurance driving and when not.”

firm. This follows a R34m investment into Ctrl, a digital Venter agrees that lockdown has caused many

short-term insurance advice platform, in July. consumers to question their static insurance premiums.

The excitement makes sense. Insurance is generally “Many insurers responded in a ‘clunky’ manner by trying to

a fast-growing sector as people in developing countries accommodate changing driving behaviours into existing

accumulate assets like houses and cars. The shift to digital, products with customers estimating and recording driving

buttressed by lockdown measures, and new technologies distances. The client experience was not great and some

like machine learning have accelerated both the demand for insurers got their pricing wrong.”

and supply of new kinds of insurance services. Unhappy customers can only mean one thing: greater

But there are also major headwinds. The SA economy opportunities for competition. Says Venter: “Lockdown

is struggling. The unwillingness of many insurers to pay for also allowed many businesses which did not traditionally

Covid-19-related damages has tainted the industry. I asked sell insurance to look for new ways to generate secondary

Pieter Venter, CEO and co-founder of Ctrl, to make the Pieter Venter revenue streams. We opened up new opportunities for these

case for investing in the insurance industry in SA. CEO and co- businesses as well. Ctrl’s platform contains all the processes

founder of Ctrl and workflows needed to start a brokerage from scratch

“Two of three vehicles on SA roads are uninsured. The

growth potential is thus enormous. Not only that, we start and setup time is minimal, thereby lowering the barriers to

off a high base; it is already a relatively large market at entry and opening the door for these businesses to enter the

around R150bn per year. Technology and innovation allow “Two of three vehicles on insurance intermediary market.”

new winners to emerge, not just in terms of new products, SA roads are uninsured. This seems almost too easy. One of the reasons why

but also in the way that insurance is distributed and sold. The growth potential is thus

Why now? I think that people are more aware of risk. Since enormous. Not only that, we the caricature of the insurance man is so pervasive, is the

red tape and regulation associated with the industry. I ask

the perils of not being insured are so much more glaring start off a high base; it is Venter what they have done to overcome the regulatory

in times of uncertainty, it may at minimum cushion the already a relatively large challenges that stifle so many insurtech start-ups.

market at around

industry from a more serious downturn in the economy.” “The regulatory challenges are real, but the way we

R150bn look at it is that once you overcome these challenges, they

Pineapple is also making waves in the SA insurtech become a moat around your business since it will be hard

space. Launched in mid-2018 with a focus on car

insurance, the company closed a Series A round at R80m per year.” for others to replicate.”

in July. According to CEO and co-founder Marnus van Innovation is not something typically associated with

Heerden, Covid-19 has indeed had a profound effect on insurance, but with an open-minded regulator a lot more

their business. seems possible. Is insurtech ready for blockchain?

“Covid-19 has affected us in three ways: consumer “We believe the decentralised space shares many

confidence, consumer behaviour changes and the common principles with Pineapple,” explains Van Heerden.

macroeconomic environment. Although a depressed “When it comes to a ‘blockchain insurer’, currently we

economic environment and consumer confidence does don’t see the ability for a completely decentralised

cause a decline in sales activity, we are fortunate that, and blockchain-based solution to appropriately service

being a digital-centric business, the consumer behaviour local short-term insurance needs. The main barriers are

changes resulting from Covid-19 have benefitted us. regulatory boundaries, computational affordability and

Our services and products are only a few taps away and Marnus van Heerden consumer appetite.”

available 24/7 from the comfort of your couch. We initially CEO and co-founder With names like Pineapple, Ctrl and Naked, a younger

expected the big shift to e-commerce in SA to happen

of Pineapple generation, equipped with digital technologies, is crushing

around 2023, but we believe this timeline has accelerated my outdated image of insurance men. That creative

with people being forced to transact online and hence destruction can only be good for the consumer – and the

gaining comfort much faster. SA economy at large. ■

Photos: Supplied “Another impact from Covid-19 we have seen is the editorial@finweek.co.za

reduction in driving, especially during lockdown periods. * finweek is a publication of Media24, a subsidiary of Naspers.

Pineapple’s car insurance product automatically includes Johan Fourie is professor in economics at Stellenbosch University and author of

our ‘Drive Less, Get Blessed’ benefit, which provides Our Long Walk to Economic Freedom (Tafelberg, 2021).

@finweek finweek finweekmagazine finweek 10 September 2021 5

in brief >> Mining: UN’s climate report calls miners to action p8

>> Chris Griffith on what the future might hold for Gold Fields p.9

>> Investment: Should investors take a chance on venture capital

and private equity? p.10

EDITORIAL & SALES “A NECESSARY STEP TO

SAFEGUARD

Acting Editor Jaco Visser Managing Editor MARKET INTEGRITY

Zerelda Esterhuizen Journalists and Contributors ANDTHE INTEREST

Simon Brown, Jacques Claassen, Amy OF ISSUERS.”

Degenhardt, Johan Fourie, Moxima Gama, Schalk

Louw, David McKay, Timothy Rangongo, Peet –The Financial Sector Conduct Authority (FSCA) commissioner, Unathi

Serfontein, Johan Steyn, Melusi Tshabalala, Kamlana, justified the FSCA’s suspension of ZAR X’s exchange licence as

Glenda Williams Sub-Editor Katrien Smit Layout a necessary step to protect the broader investing public. ZAR X is SA’s first

Artists David Kyslinger, Beku Mbotoli, Mini Zwane alternative exchange, operating since February 2017. The FSCA cited non-

Advertising Paul Goddard 082 650 9231/paul@ compliance with the Financial Markets Act and regulations relating to an

fivetwelve.co.za, Tanya Finch 082 961 9429/ exchange’s liquidity and capital adequacy requirements as grounds for the

tanya@fivetwelve.co.za, Nina Frank 084 434 suspension. The exchange licence will be cancelled if the non-compliance is not

7776/ nina@fivetwelve.co.za Publisher Sandra rectified within three months. ZAR X lodged an appeal against the decision.

Ladas sandra.ladas@newmedia.co.za General

Manager Dev Naidoo Production Angela Silver “[Woolworths’ focus] absolutely

angela.silver@newmedia.co.za remains playing with the cards

we’ve got.”

Published by New Media, a division of Media24 (Pty)

Ltd Johannesburg Office: Ground floor, Media Park, 69 – Woolworths Group CEO Roy Bagattini put to bed a widespread proposition

Kingsway Avenue, Auckland Park, 2092 Postal Address: by fund managers and analysts for the retailer to separately list its food division.

PO Box 784698, Sandton, Johannesburg, 2146 Tel: +27 A July research report by analysts Rod Salmon and Chris Gilmour at Salmour

(0)11 713 9601 Head Office: 8th floor, Media24 Centre, 40 Research recommended demerging and forming a separate listed entity that

Heerengracht, Cape Town 8001 Postal Address: PO Box 440, would result in a higher operating margin and unique position protected by higher

Green Point, Cape Town, 8051 Tel: Tel: +27 (0) 21 406 2002 barriers to entry. Bagattini told Business Times the group will continue consistently

Email: newmedia@newmedia.co.za growing the food business ahead of the market as it has done in past years.

Printed by CTP Printers, Cape Town and Distributed by “THE TRUTH IS, THIS DID UNFOLD

On The Dot Website: http://www.fin24.com/finweek MORE QUICKLY THAN WE HAD

Overseas Subscribers: +27 21 405 1905/7 ANTICIPATED.”

ENQUIRIES – US President Joe Biden said the events in Afghanistan are proof that no

amount of military force would have delivered a stable, united and secure country.

SUBSCRIBERS Fax SHOPS The White House appeared to be caught off-guard by the Taliban’s rapid advance

087-353-1305 0864-575-918 0861-888-989 and capture of the Afghan capital, Kabul. Responding to criticism that the US

subs@finweek.co.za assistance@onthedot.co.za should have started evacuations sooner, Biden said in a televised press conference

some Afghans hadn’t wanted to leave earlier in hope that it would not be

Share your thoughts with us on: necessary and that the Afghan government discouraged a mass exodus.

@finweek finweek finweekmagazine www.fin24.com/finweek

FINWEEK SUBSCRIBES TO THE SOUTH AFRICAN PRESS CODE WHICH COMMITS US TO JOURNALISM THAT IS

TRUE, ACCURATE, FAIR AND BALANCED. IF YOU THINK WE ARE NOT COMPLYING WITH THE CODE, CONTACT THE

PRESS OMBUDSMAN AT 011-484-3612 OR ombudsman@presscouncil.org.za © FINWEEK 2011 ALL RIGHTS

RESERVED. TO INQUIRE ABOUT PERMISSION TO REPRODUCE MATERIAL CALL OUR ARCHIVE AT 021-406-3232.

6 finweek 10 September 2021

THE DOUBLE TAKE BY RICO

GOOD

GLOBAL WEALTH

The agriculture export performance

results for the first and second quarters $250tr

of 2021 reflect the resilience of the sector

amid ongoing Covid-19-related challenges Global financial wealth reached an all-time

across the planet, according to Paul high of $250tr in 2020 as household savings

Makube, senior agricultural economist rose and markets showed unexpected

at FNB Agri-Business. He said the sector resilience in the face of the protracted Covid-

managed to move a large quantity of 19 pandemic, according to Boston Consulting

produce to the rest of the world with the Group’s Global Wealth 2021 report. Africa,

second quarter of 2021 recording a trade and South Africa, also enjoyed increased

surplus of $1.5bn, which is 40% ahead of financial wealth – particularly for ultra-high-

the same period in 2020. This follows a net-worth individuals (individuals whose

36% year-on-year spike in total agriculture personal wealth exceeds $100m) and the

exports in the second quarter of 2021 at middle class.

$3.2bn, bringing the total half-year 2021

export value to $6.1bn, which is 30% INSURANCE CLAIMS DUE TO UNREST

higher year-on-year.

95%

THE

BAD The direct impact and lasting effect of the

unrest in July could reduce SA’s GDP growth

The Automobile Association (AA) UNITTRUST ASSETS UNDER MANAGEMENT by 0.8 percentage points in 2021, according

lambasted proposed route extensions to forecasts by PwC economists. The hard-

to the Gautrain as they will perpetuate R3tr hit KwaZulu-Natal and Gauteng economies

a system which caters for the minority represent half of the country’s GDP. Sasria

of Gauteng citizens who don’t need it, The local Collective Investment Schemes (CIS) said it has registered over 95% of all related

instead of the mass market which does. industry reported net outflows of R18bn for the insurance claims, which are currently being

The AA said the so-called “Patronage second quarter of 2021 following the closure of attended to. It estimates that the total number

Guarantee” is a mechanism whereby the SA’s biggest money market fund, the R80bn Absa of claims would reach between R19bn and

Gautrain operator is compensated for money market fund. Meanwhile, CIS assets under R20bn, once the phases of quantifying claims

sub-par ridership levels, meaning they management are approaching the R3tr threshold, and the finalisation of the work done by loss

can rely on the provincial government as according to Sunette Mulder, senior policy advisor adjustors are completed.

a funder of last resort regardless of how at the Association for Savings and Investment

well or badly their business fares. “It’s a South Africa. At 30 June 2021, the CIS industry * finweek is a publication of Media24, a subsidiary of Naspers.

disgraceful and outrageous agreement managed assets of R2.9tr, representing growth of

which has cost taxpayers close on R12bn close to R2tr in less than 10 years.

since 2012 just because not enough

people see value in using the Gautrain,”

said the AA.

Photo: Rhodes University THE REDUCED INDEX CONCENTRATION

UGLY

6.3%

SA’s headline unemployment rate hit

a record high of 34.4% in the second On 17 August, R145bn of equities were

quarter from 32.6% in the first three traded on the JSE, which caused significant

months as businesses shed staff due delays in processing on some systems, with

to the devastating economic impact of full dealing starting aft 14:30 the next day.

Covid-19. According to an expanded Trading surpassed a previous record of R71bn

definition of unemployment that includes from December 2017. The bourse struggled

people discouraged from seeking work, to process transactions in the previous

44.4% of the labour force was without session as investors adjusted their holdings

work in the second quarter, from 43.2% in Naspers*. The stock fell 8.1% on surging

in the first. That equates to 11.9m people volumes as money managers adjusted

unemployed. Job losses in the second their portfolios following the company’s

quarter were mainly in finance, which share swap deal with Prosus. Naspers now

shed 278 000 jobs, while community accounts for 6.3% of the FTSE/JSE Africa All

and social services lost 166 000 jobs and Share Index compared with 12% on

manufacturing lost 83 000 jobs. 17 August, reported Bloomberg.

@finweek finweek finweekmagazine finweek 10 September 2021 7

in brief in the news

By David McKay

MINING

‘Pulling all stops’ on climate change

The UN’s recent report on the impact of human beings on planetwide temperatures is a call to action for miners.

t he view of mining executives polled secretary-general of the United Nations. “This Mark Bristow July Ndlovu

by finweek is that a discussion about report must sound the death knell for coal and CEO of Barrick Gold CEO of Thungela Resources

reducing greenhouse gas emissions fossil fuels before they destroy our planet,”

Photos: Shutterstock | Supplied can’t exclude the rights of people in Guterres was quoted as saying. “If we think beyond this ‘winner-loser’

poorer economies, especially in Africa. debate on fossil fuel, it will call for an agnostic

“Scientists are looking at just one The report comes about two months technology solution.” Ndlovu believes that

component,” says Mark Bristow, CEO of before the UN Climate Change Conference could spell good news forThungela Resources

Barrick Gold, one of the world’s largest gold (COP26) scheduled for 31 October. Both the as it sets about sourcing financials for the

producers. “But are we going to deny the report and conference are likely to sensitise extension of certain projects, as well as

development of mankind? If you do, you the market yet further regarding the efforts of continuing to attract shareholders to the

will compound the problem,” he said in an mining firms to cut emissions; coal producers register.

interview with finweek in August. Climate in particular.

change is humanity’s most profound challenge “Technology is a limiting challenge,” says

but a lack of development in undeveloped “I expect [the report] to raise the Bristow, who adds that the world can’t be run

economies will also cost lives. ante,” says July Ndlovu, CEO of Thungela just on solar and wind power. “Hydrogen is

Climate change has long been an emotive Resources, of the pressure on coal miners the ultimate renewable power but it requires a

topic in the mining sector, as it has broadly to scale back and ultimately shut their real commitment to technology and thought.

in society; probably ever since the Paris businesses. “But is the report raising new And in this regard, we have to keep our

Agreement of 2016 that committed some issues? Probably not,” he added. options open. We can’t go down rabbit holes,”

of the world’s most industrialised economies he says.

to containing global warming to 2°C above Ndlovu was commenting on the day

pre-industrial levels. But the debate kicked up the firm reported stand-out debut interim Chris Griffith, CEO of Gold Fields, thinks “all

a notch following the publication on 9 August results amid a major recovery in the thermal levers have to be pulled” to avoid the current

of a report by the UN’s Intergovernmental coal price. The reason for the price recovery trajectory of far in excess of 2°C warming in

Panel on Climate Change, described as is that the world is concerned about supply. a context where world population is to grow

“epochal”. According to Ndlovu, coal supply is a critical by 2%. “You’ve got to use less electricity with

The essence of the report is that it pillar for many developing economies, SA in the majority of fossil fuels eliminated. And

firmly blamed the planet’s rising average particular. This can’t be ignored in the global you need technology in order to store fuel and

temperatures on humans, and that without warming debate. technology to use hydrogen.” ■

drastic measures, an average increase in the editorial@finweek.co.za

temperature of 1.5°C was inevitable within “I want to look beyond the headlines.

two decades – beyond the stretch target set One of the things they say in the report ... is

in the Paris Agreement. The report has been that for us to get to either net zero or below

interpreted as a “last chance saloon” moment 1.5°C, we have to invest in carbon removal

for the world. technologies. What that is beginning to call

The document is “a code red for humanity”, for – for the first time – is a pathway that

said Bloomberg News, citing António Guterres, focuses on technologies that can mitigate

global warming. That can include renewable

energy technologies, but equally it includes

mitigation technologies such as carbon

removal,” he says.

8 finweek 10 September 2021 www.fin24.com/finweek

in brief in the news

By David McKay

MINING

Value over volume?

f Chris Griffith, the CEO of Gold Fields, talks about the firm’s production and future.

ormer Gold Fields CEO Nick Holland “With the jurisdictions we have got, and

won plaudits prior to his retirement where we are growing, and having created

announcement in August 2020 value of 2.7m ounces ... to let that slip off

for having invested in new gold the other side of the hill doesn’t feel like the

production, especially at a time when the right long-term solution,” he says.

gold price was relatively low. What’s not planned, however, is the

Establishing a base of about 2m ounces takeover of companies, which would appear

in gold annually for 10 years was ahead of to rule out a bid for the other half of Ghana

the gold industry curve, especially as the assets held in joint venture with Toronto-

sector has been reticent to invest in new listed Asanko Gold. “We’ve been good at

gold resources, analysts said.To some buying assets rather than companies,” he

extent, this assessment was reflected in says. Gold Fields’ Australian mines will be

Gold Fields’ share price, which gained 43% operating for 20 years even though they

compared to a slim 3.5% gain for rival had a life of less than 10 years when they

AngloGold Ashanti over the course of 2020. were first bought.

Today, however, that’s not enough. Griffith is ambitious by nature so it’s

Chris Griffith, Gold Fields CEO, is keen no surprise the high-water mark of 2.7m

to arrest the decline in the ounces is one he wants to maintain

firm’s production from a for Gold Fields. Given his

peak of 2.7m ounces in former role as CEO of Anglo Chris Griffith

CEO of Gold Fields

2024. He hopes to American Platinum, the

Whilst Griffith is

achieve this through market also speculated keen to talk about

chasing “value over

a combination of he could push Gold volume” – a common

mining principle – his

acquisitions and Fields into metal interest in avoiding a

slide in production off

organic growth. The diversification. That is historically high levels

for Gold Fields sounds

plans are strategic not on the radar now. a bit like keeping up

appearances, however?

at this stage. “At the moment

Whilst Griffith there’s no focus on

is keen to talk about other commodities. It

chasing “value over doesn’t mean we’ll never

volume” – a common do it, but it’s not what

mining principle – his the market or shareholders

interest in avoiding a slide in want,” he said in response to an

production off historically high levels for analyst question. It’s an interesting way of

Gold Fields sounds a bit like keeping up describing the strategy because it’s framed

appearances, however? as if the market responded to the question

Griffith responds that the key to of diversification, possibly by Griffith himself.

maintaining a share price premium is Gold Fields is also sticking with South

first and foremost having quality assets, Deep instead of selling it, as had been

management credibility, and a quality in the speculated. The theory is that South Deep,

jurisdiction of the asset. (Griffith observes a mine bought in 2006 for R22bn, was

that though it’s only 10% of production, Holland’s pet project and that Griffith

the company’s SA mine South Deep tends would be tempted to sell it, partly to

still to attract a discount.) Beyond that, dispense with the jurisdictional albatross

Photos: Shutterstock | Gallo/Getty Images however, size does seem to matter, he says. that is SA.

“There is some correlation to size as “It has all the hallmarks of a Gold Fields

long as you’ve got those other things in franchise asset,” said Griffith. It’s a logical

place,” Griffith said in an interview with conclusion: South Deep has now made

finweek shortly after the group reported money for the last two years, and it’s safer

its interim numbers. “If you’ve just got size to keep the mine ticking over rather than

but have some other challenges, then you risk someone else capitalising on Gold

don’t get to ‘base two’ of how investment Fields’ work of the last 15 years. ■

analysts rate the share,” he says. editorial@finweek.co.za

@finweek finweek finweekmagazine finweek 10 September 2021 9

in brief in the news

By Timothy Rangongo

INVESTMENT

A review of SA’s venture capital and

private equity classes

w Should investors take a chance on these classes? national Andrew Barnes in 2015, educational tech startup Go1 was

hile public markets were decimated by the knock- established with a mission to unlock people’s potential through a love

on effects of the Covid-19 pandemic in 2020, of learning. How? By helping connect learners and businesses with

the same cannot be said for private markets, content publishers in a single subscription.

particularly the venture capital and private equity

asset subclasses. Private market asset classes continued to perform The edtech platform essentially collates existing learning material

well globally, outpacing most measures of comparable public market from leading global educational institutions into a central digital library,

performance.The strength and speed of the rebound suggest making corporate training simple for employees and employers.

resilience and continued momentum as investors looked to In six years, Go1 increased its user base by more than 300%

private markets for higher potential returns in a sustained year-over-year, and now support more than 1 700 customers

low-yield environment. worldwide, according to co-founder and CEO Barnes.While

In 2019, the South African Venture Capital and Private Go1 has reached over 3.5m learners, he says that “internally

Equity Association (SAVCA) said 69 early-stage fund we talk about a vision of reaching 1bn learners”.

managers had invested R1.23bn into new and start-up “Looking ahead, this investment will unlock capacity for

stage SA businesses. In 2020, one would have assumed this Tanya van Lill us to accelerate product development for our merchants and

figure to have declined as deals dried up due to pressures CEO of SAVCA continue on our growth trajectory in SA and beyond,” said

brought on by the pandemic. Instead, another record year Katlego Maphai, CEO ofYoco, in a statement following the

was concluded. SAVCA’s 2020 venture capital survey showed announcement of the R1.2bn raised.

that 74 SA early-stage fund managers had invested R1.39bn It brought the total funds raised by the company to date

into 122 entities through 167 investment rounds, amidst a to $107m. Over the next two years,Yoco plans to expand into

turbulent economic climate. other African countries and the Middle East and reach 1m

The top five sectors that received the most investment, merchants in the next four years.

based on number of investments, were software, fintech, Also in the same month, Johannesburg-based insurance

business products and services, consumer products and start-up Pineapple announced that it had closed its Series

services, and health, according to Tanya van Lill, CEO of A funding round with R80m secured from investors. In a

SAVCA. She tells finweek that SAVCA members indicated Katlego Maphai statement, co-founder Ndabenhle Ngulube attributed the

that the bigger part of 2020 was used to support their CEO of Yoco round’s success to the app’s growth in 2021.

existing private equity portfolios and ensure companies

“We did not expect to grow by 200% in the first six months

weather the crisis, and that deal activity only picked up again of this year, but it goes to show that customer insurance

in the latter part of the year. “Whereas the venture capital purchase behaviour is starting to shift online and that

industry invested in businesses that were most probably more customers are becoming more astute as to the online ratings of

agile or experienced exponential growth as a result of the insurance providers and not settling for second-best,” he said.

pandemic and changing consumer behaviours.” Venture capital and private equity outlook

Notable deals For venture capital and private equity to continue investing

Van Lill says in the private equity space there has been and adding value, they need to be able to raise funds, says Van

a lot more deals and co-investments related to digital Ketso Gordhan Lill. “It is currently very difficult to raise funds given the current

infrastructure and related industries, given how the pandemic CEO at SA SME Fund economic environment in SA.

amplified the vulnerabilities and lack of investment in critical

“Investors expect financial returns, with some also looking

digital infrastructure. to achieve certain impact metrics. However, in order to

In the venture capital space, we saw investments into Brown and achieve good financial returns and attract investors (both local and

Ayo (lifestyle hair brand), Koa Academy (an online school), Kandua international), we need a stable political environment, policy certainty

(marketplace for home services), and Ctrl (digital insurance), all in the and GDP growth.”

month of July. However, the most recent notable deals that proffered She says that SA also needs a vibrant exit environment so that

a glimmer of hope for local SMEs were by favourites such as Yoco investors can realise returns and find it attractive to reinvest in the

which raised $83m in Series C funding; and Go1, which raised $200m economy.

in Series D funding. “There is room for improvement in terms of the country needing

Photos: Supplied “This shows that there are a lot of opportunities and new more women-controlled teams and funds. Having said that, our

innovations coming to the market from our own entrepreneurs,” says attitude towards diversity is improving and we need to recognise that,”

Van Lill. says Ketso Gordhan, CEO at SA SME Fund. ■

Founded by SA entrepreneur Melvyn Lubega and Australian editorial@finweek.co.za

10 finweek 10 September 2021 www.fin24.com/finweek

market >> House View: Merafe Resources, Sibanye-Stillwater p.12

place >> Killer Trade: Shoprite p.13

>> Invest DIY: What’s the purpose of net asset value? p.14

>> Investment: Looking at asset classes relative to each other p.15

>> Share View: mRNA technology could become a life-saver p.16

>> Invest DIY: How to manage fear p.17

>> Simon Says: ARB Holdings, coal miners, Curro, Massmart, Metair, Naspers, Purple Group,

Sasol, Sibanye-Stillwater p.18

>> Investment: PMI data: an early warning system p.20

FUND IN FOCUS: PORTFOLIOMETRIX BCI SA EQUITY FUND By Timothy Rangongo

A focus on specialist skillsets

The PortfolioMetrix BCI SA Equity Fund is a domestic general equity fund that aims to secure high long-term capital growth.

FUND INFORMATION Fund manager insights:

Benchmark: FTSE/JSE CAPI SWIX The PortfolioMetrix BCI SA Equity Fund seeks out attractively-valued shares of

companies listed on the JSE that could achieve strong investment growth over the

Fund managers: PortfolioMetrix Asset Management long run.The portfolio may also invest in participatory interests and other forms

of participation in portfolios of collective investment schemes, as it has with the

Fund classification: South African – Equity – General Coronation, Fairtree, 36ONE and Satrix funds, which feature in its top 10 holdings.

Total investment charge: 1.85% “We believe that the specialist will outperform the generalist over time,” says

Brendan de Jongh, head of research at PortfolioMetrix, on the allocation to external

Fund size: R6.4bn collective investment schemes in the portfolio. “We therefore prefer seeking out

specialist skillsets within asset classes and building portfolios with these skillsets

Minimum lump sum/ None/R15 excl. VAT on all direct investor accounts with [rather] than trying to perform all functions in-house. We think this strategy is

subsequent investment: balances of less than R100 000 pragmatic and should result in superior risk-adjusted performance over time.”

Contact details: 011 568 3400/info@portfoliometrix.co.za While the fund has enjoyed strong absolute and relative performance year-to-date

and over longer time periods, De Jongh emphasises that it is important to understand

TOP 10 HOLDINGS AS AT 31 JULY 2021: 19.1% what has driven these returns as the need to examine outperformance is just as

18.9% important as analysing underperformance.The fund’s biggest concern in constructing

1 Coronation Top 20 10% portfolios is that of concentrated risk and the probability of success. “We have had a

2 Fairtree Equity Prescient 7.5% market that has been driven by strong commodity returns which is cyclical in nature.

3 36ONE BCI SA Equity 4.2% On the other hand, you have domestically focused companies that seem very cheap but

4 Satrix Mid-Cap Index 2.9% face a difficult operating environment.”

5 Naspers* 2.8%

6 Anglo American 2.1% The management of risks between these two themes has been a challenge,

7 FirstRand 1.7% according to De Jongh.The fund employs a multi-managed strategy that is biased

8 MTN 1.7% towards active management in the South African market. “Diversification of fund

9 Impala Platinum 70.9% strategy, differing views and positioning produces a portfolio that manages these risks

10 Standard Bank and can still outperform after costs,” he says.

TOTAL Prosus recently announced all conditions for its offer to buy Naspers shares

* finweek is a publication of Media24, a subsidiary of Naspers. had been met and that a deal to set up a cross-holding structure between the two

companies will proceed. PortfolioMetrix says the complexity of the cross-shareholding

PERFORMANCE (ANNUALISED AFTER FEES) between Prosus and Naspers is not ideal and, like most investors, they shy away from

complexity. “Although the transaction will not result in immediate value unlock, we are

as at 31 July 2021: of the opinion that the transaction is a step in the right direction and offers opportunity

for further transactions to alleviate the embedded discounts.”

■ PortfolioMetrix BCI SA Equity Fund ■ Benchmark

The fund did not engage in any material repositioning of the Naspers holding in the

30 portfolio due to this.

29.91% Why finweek would consider adding it:

25 The fund offers full exposure to shares listed in South Africa. JSE shares are also

trading at a 50% discount to the MSCI World Index and are at their lowest relative

27.08% rating in almost two decades. Given this, much negativity is already priced into the

market and provides a good starting point for potential prospective returns, according

20 to De Jongh. ■

editorial@finweek.co.za

15

10

5 7.29%

4.91%

0

1 year Since inception in November 2014

@finweek finweek finweekmagazine finweek 10 September 2021 11

marketplace house view

MERAFE RESOURCES BUY SELL HOLD By Simon Brown

Solid results Last trade ideas

Merafe Resources has had a wild listing, peaking at over 400c BUY Murray & Roberts

in 2008. Ensuing load-shedding and collapsing demand 20 August issue

subsequently sent the stock lower to under 100c where it has

struggled along for the last couple of years with the occasional BUY Cashbuild

move towards 200c.The only asset is a minority holding, via 6 August issue

Merafe Ferrochrome and Mining, with Glencore in what is the

world’s largest ferrochrome miner. HOLD Satrix China ETF

23 July issue

Recent results were very strong but what really caught my

attention was a 66% increase in production as prices soar. But SELL JSE

what stood out even more was inventories at R1.4bn and cash of 9 July issue

almost R800m.This totals R2.2bn with the current market cap, at

a 97c share price, standing at R2.4bn.

The market has never really liked the minority stake as it

means they have no control. Ferrochrome demand has rocketed

as the alloy is used in steel production, which may wane over time.

This is not news, however, so one is waiting for a trigger to send

the price higher, most likely increased demand or reduced global

production, especially out of China due to power reform policies. ■

SIBANYE-STILLWATER BUY SELL HOLD By Moxima Gama

Correction on the cards? Last trade ideas

Sibanye-Stillwater is the world’s largest primary producer of BUY MTN

platinum, the second-largest primary producer of palladium and a 20 August issue

top-tier gold producer, ranking third globally on a gold-equivalent

basis, as well as a significant producer of rhodium and other BUY Truworths

platinum group metals (PGMs) and associated minerals such as 6 August issue

chrome.The group recently declared an R8.54bn interim dividend

for the six months to end-June after another record financial SELL Transaction Capital

performance.Thanks to improved operational performance 23 July issue

paired with exceptionally strong precious metals prices, the group

profit was doubled to R24.32bn compared with R9.73bn in the SELL BHP

same period a year earlier – also surpassing the previous high of 9 July issue

R20.89bn in the second half of 2020. Headline earnings per share

Photos: meraferesources.co.za | Archive surged 141% year-on-year to 835c. All this has allowed Sibanye to Headline earnings per

declare an interim dividend of 292c/share. share surged

On the charts Sibanye exceeded its all-time high at 7 250c/ 141%

share and formed a new high at 7 665c/share in March. But year-on-year to 835c.

after that, the share started to form falling tops which have now All this has allowed Sibanye

resulted in a breakout of its current uptrend.This is triggering to declare an interim dividend

a caution signal, potentially insinuating that the share price is

exhausted and may embark on a correction. of 292c/share.

How to trade it:

Sibanye is currently teetering on a key support level at 5 845c/

share. If the information above triggers upside, but the share

fails to trade above 6 480c/share or even 7 000c/share, then

reduce long positions and sell completely below 5 845c/share.

A correction may then commence towards 4 450c/share and

breaching that level could see the share fall further to 3 150c.

Alternatively, Sibanye would have to trade above 7 665c/share

to initiate a new bull phase to new highs. Failing which, it could

consolidate on the top side before falling. ■

editorial@finweek.co.za

12 finweek 10 September 2021 www.fin24.com/finweek

marketplace killer trade

By Moxima Gama

SHOPRITE

Looking to recoup its losseshopriteis Africa’slargestgrocery

retailer, operating 2 840 outlets in 15

s countries across Africa and the Indian

SHOPRITE (WEEKLY CHART)

Ocean Islands. Its brands include

Checkers, Checkers Hyper, Usave, Hungry Lion,

OK Furniture, OK Power Express, OK Furniture

Dreams and House & Home. It has secondary

listings on both the Namibian and Zambian

stock exchanges.

Share price history to rebuild and restock 89 stores so far. 52-week range: SOURCE: MetaStock Pro (Reuters)

Price/earnings ratio:

After correcting for three years between 2013 On the charts 1-year total return: R109.89 - R184.57

and 2016, Shoprite’s share price extended Market capitalisation: 22.5

its long-term bull trend to an all-time high at Shoprite’s share price traded through the Earnings per share: 67%

28 190c/share in March 2018 – this was despite support trendline of its bear trend and is Dividend yield:

the resignation of former CEO Whitey Basson in maintaining a steady uptrend. A recent Average volume over 30 days: R108.7bn

December 2017. announcement that sparked further optimism R8.14

was the group’s plan to withdraw from Uganda 2.27%

However, after announcing its first drop in and Madagascar markets after announcing

earnings in 2018 since 1998, which was the an 8.1% increase in total merchandise sales 1 369 732

year when Shoprite acquired OK Bazaars for R1 from continuing operations to R168bn for the

from SA Breweries, the share price embarked 53 weeks ended 4 July 2021.The company SOURCE: BLOOMBERG

on a prolonged downward slide. “We’ve been has already exited its Nigerian business of 15

to war,” is how the new CEO Pieter Engelbrecht years in which it had a hefty $30bn worth of share. Now that Shoprite has surpassed that

described trading conditions behind their first investments and is looking to close its Kenyan target, further gains may be in the offing.

drop in earnings in 20 years, aggravated by stores next year. Currency devaluations, lower Another buying opportunity was presented

armed robberies, record fuel prices, chronic commodity prices and high inflation have above 16 375c/share, but because the three-

unemployment, industrial action and the first negatively impacted household disposable week relative strength index (3W RSI) is

VAT hike in South Africa in 25 years.The group’s incomes and has weighed on its earnings over extremely overbought, we should anticipate

profits were further knocked by a hefty adverse the past years. a near-term pullback. If support holds at

effect of low inflation and the devaluation of 16 385c/share, go long or increase positions,

the Angolan currency by 50% – Angola was the What to anticipate as gains could extend further to resistance at

group’s star performer outside SA, generating 25 250c/share. Breaching that level could see

about 60% growth earnings. Shoprite’s share Shoprite’s share price is recovering its previous Shoprite’s share price revisit its all-time high

price plummeted to a low at 9 500c/share. losses and if the current uptrend should persist, at 28 190c/share.

the share price could retest its all-time high at Go short: If the share price corrects from

Current outlook 28 190c/share in the medium to long term. its mega-overbought position and trades

through the support trendline of its current

Shoprite’s share price managed to recover after How to trade it: uptrend, a negative breakout confirmed below

retaining firm support at 9 500c/share and 15 170c/share would mark a bearish change in

traded out of its bear trend in August 2020. Go long: In August last year, I had sentiment. Downside to 12 455c/share could

Despite announcing a R100m loss in turnover recommended a long position on Shoprite ensue, in which case, refrain from going long. ■

because of the Covid-19 pandemic, shareholders when it confirmed a positive breakout of its editorial@finweek.co.za

seemed undeterred as the share price took on a long-term bear trend above 12 975c/share

bullish direction.This direction was driven higher – the first target was situated at 16 755c/ Moxima Gama is an independent stock market analyst at The

on the back of Shoprite reporting a jump in half- Money Hub.

year group profit and increased domestic market

share in SA after scaling back on its continental

expansion. Its star performer was its upmarket

Checkers chain, which had been investing

vigorously in its same-day-delivery online

grocery service and expanding its new-format

stores to challengeWoolworths. Not even the

lootings that took place in July, during which

200 stores across the group fell victim, veered

the share price off its current bull trend. Shoprite

worked tirelessly to reopen stores – managing

@finweek finweek finweekmagazine finweek 10 September 2021 13

marketplace invest DIY

By Simon Brown

INVESTMENT

How to use net asset value

when considering stocks

o A company’s NAV might be a trap. There’s more to this valuation metric.

n a recent JSE online down over time as we saw with Sasol’s

event I attended, several misadventure at Lake Charles.

investment experts

But it is this paying more than

were giving stock picks NAV that has got many investors

when the topic of net asset value scratching their heads. The answer is

(NAV) came up in relation to how all simple: when buying a company as

the stocks being picked were trading an investment you’re not buying it

above their NAV. As I often refer to for the breakup value, you’re buying it

NAV in my columns, I thought it would for the future profits. Therefore, RoE

be worth going into detail. is an important ratio: what profits do

Firstly, what is NAV? It is a metric the NAV generate? The breakup value

derived from the balance sheet and only matters if things go wrong, and

essentially entails subtracting all the company goes bust.

liabilities from all assets. This is also This is the challenge for those

the equity value we use in ratios such looking to buy stocks below NAV,

as return on equity (RoE). Hence, it is considering them to be offering great

the breakup value of the company. value. The logic is sound, but the

NAV is also a function of a holding experience is often not. Is it value or

company whereby it is the value of all a value trap? I remember more than

their assets less any liabilities, often once finding a stock below NAV and

the tax on profits or debt. jumping in only for the value to never

I have written recently about how unlock. In the case of Argent that

holding companies typically trade discount to NAV is unlocking, but it

at a discount to their NAV but that has been a decade-long wait. But it is this paying

more than NAV that

currently we’re seeing larger discounts There is also tangible NAV has got many investors

than normal. For example, Remgro (TNAV), which is my preferred NAV. scratching their

heads. The answer is

traditionally traded at a 15% to 20% This excludes intangible assets and simple: when buying

discount to their NAV but recently it hence it is hard to sell assets such a company as an

investment you’re not

has been trading at a 40% discount. as goodwill. So TNAV is much purer buying it for the breakup

value, you’re buying it

One of the easier parts of a holding but can still lead to value traps. The for the future profits.

company’s NAV is if the holdings are Don Group traded below the value of

listed and one can use that listed price their properties, never mind NAV, but

to calculate the NAV. When assets are always struggled and was eventually

unlisted things can get tricky. delisted well below the TNAV value.

When looking at a single company, Lastly, different industries trade at

the valuation of unlisted assets is different premiums to NAV. Banks are

the challenge. Sometimes it is just usually around 1.5 times NAV (called

inventories and then easy to calculate, book value in banker speak) but

albeit are they valued at cost or retail currently most of them trade below

price? Ideally it should be at cost their book values. Do they offer value?

as the sale may not happen or may Property stocks peaked at around a

happen at a discount to the usual 35% premium to NAV but are now

selling price. trading at around a 35% discount to

There is also the issue of goodwill. NAV and the longer-term average is a

When a company buys another, premium of between 10% and 15%.

they’ll pay above the NAV of the So, to conclude, paying above NAV

Photo: Shutterstock target company and that extra value for a quality company is fine; and be

is added to the balance sheet as an careful with a discount to NAV as it

asset – goodwill. If the purchase goes may be a trap. ■

awry, then they can write that goodwill editorial@finweek.co.za

14 finweek 10 September 2021 www.fin24.com/finweek

marketplace investment

By Schalk Louw

PORTFOLIO CONSTRUCTION

Relativity in the investment world

r Which asset classes boast the best value relative to others?

elativity in the investment world is as important as it 1.8 FTSE/JSE ALL SHARE INDEX EARNINGSYIELD

is in the real world. Let’s use the Covid-19 pandemic RELATIVE TO OTHER ASSETCLASSES

as an example: South Africa and Italy both have a

RELATIVELY CHEAP

population of around 60m people. We know that

Italy was one of the hardest hit countries in the world at 1.6

the onset of the pandemic, and up to the end of 2020 they 1.4

lost an average of 185 people per day to Covid-19. South 1.2

Africa was hit just as hard but lost relatively fewer people to

Covid-19 with an average of 100 deaths per day up to the 1

end of 2020. Italy was more successful with their vaccination

programme this year, however, and up to and including 0.8

16 August 2021 (according to the WHO), 31.4m people have 0.6 RELATIVELY EXPENSIVE

been fully vaccinated.

Here, SA was relatively slower with the roll-out of its 0.4

vaccination programme and over the same period, only

3.7m people were fully vaccinated. While Italy’s Covid-19- Aug ’06 Aug ’07 Aug ’08 Aug ’09 Aug ’10 Aug ’11 Aug ’12 Aug ’13 Aug ’14 Aug ’15 Aug ’16 Aug ’17 Aug ’18 Aug ’19 Aug ’20

SOURCE: PSG Old Oak & Iress

related deaths declined from an average of 181 per day at

the beginning of this year to 47 per day over the past three yield (over the past 15 years) is trading at 93% (0.93 times)

months, SA’s death toll rose to an average of 215 per day for compared to the average earnings of the remaining four

the whole of 2021 so far, with this figure now on the rise at a asset classes (money market, property shares, local bonds

current average of 239 per day over the past three months. and offshore investments).

It’s therefore clear that the second and third waves have hit At the current 155% ratio, it’s showing us that local shares’

SA much harder than it hit Italy, and I would argue that is returns are still trading relatively cheaply against the other

largely due to Italy’s successful vaccine programme. asset classes, and that it hasn’t been this relatively cheap in

I’m well aware that there are variables such as seasons, the last 15 years. Of course, this includes the 2008 correction.

virus mutations and demographic profiles which will have an Now, this doesn’t mean that you should invest all of your

effect on these figures, but this just shows why the relativity capital in this one asset class, but rather that you should be

principle (and seeing the bigger picture) is so important careful to not exclude it from your portfolio entirely.

when making comparisons. Following the past almost two years’ interest

The same relativity principles can be applied rate cuts, the money market has offered relatively

in the investment world where they are just as little value. Offshore investments, especially in

versatile. It can be used to tell you more about developed countries, was a good place to be these

where we stand marketwise, and even though past few years. But because this model mainly

it’s mostly based on historical data, it can also looks at relative returns, I want to urge investors

tell you how cheap or expensive a particular to approach offshore investments with great

share, currency, commodity, bond or sector is caution, simply because this model doesn’t really

relative to another. look at foreign exchange.The relativity indicator

Studies have shown that more than 90% of is showing us that this asset class is now offering

good long-term investment results are achieved relatively less value and this may mean that you

through proper asset allocation, and only 10% through should consider rebalancing to ensure that you remain

good sector and market timing. A balanced portfolio well within your personal risk profile.

can be divided into five main asset classes: the money The relativity indicator is showing us that you should still

market, local bonds, property shares, local shares and offshore be cautious when considering investing in the SA property

investments. For ease of reference, I have allocated 60% of sector. The SA bond sector is looking similar to SA shares –

offshore investments to a World Equity Index and 40% to a very attractive. This is mainly due to SA’s downgrade to junk

World Government Bond Index. Diversification remains an status last year.

investor’s best defence against risk and that’s why it’s so In conclusion, our investment environment remains

important to not focus on just one of these asset classes. challenging. But you can manage your own portfolio,

Photo: Shutterstock All five of these asset classes have historical returns. provided you firstly look at proper portfolio diversification and

By comparing these returns with one another you can secondly, by limiting overweight positions in assets that are

get a good indication of how cheap or expensive they are offering you relatively less value compared to others. ■

compared with one another. If we use shares as an example, editorial@finweek.co.za

you will see that this asset class’ historical average earnings Schalk Louw is a portfolio manager at PSG Wealth Old Oak.

@finweek finweek finweekmagazine finweek 10 September 2021 15

marketplace share view

By Peet Serfontein

ANALYSIS

Pandemics, politics, conspiracy

theories – what’s next?

w Could mRNA technology open the door for the treatment of other diseases?

hile the Covid-19 pandemic LONCAR CANCER IMMUNOTHERAPY ETF ($) 52-week range: $23.99 - $35.81

has spread aggressively

and quickly over the whole – 40.00

world, society has also – 38.00

– 36.00 Year-to-date return: -3.64%

–– 34.00

32.00

– 30.00

– 28.00 1-year total return: 14.5%

– 26.00

seen the evolution and spread of other “viral” 3-month return: 0.12%

phenomena, including the dissemination of – 24.00

– 22.50

– 21.00

fake news, information conspiracy theories – 19.50 Expense ratio: 0.79%

and general mass suspicions about what is ––

truly happening. We all know that the world is 18.50 Indicated dividend yield: 0.94%

no longer the same as it was a few years ago. 17.50

Things have changed and will possibly keep – 16.50

– 15.50

–– 14.70

–– 13.90 Assets under management: $44.4m

13.10

12.40

– 11.75

SOURCE: BLOOMBERG

on changing. 2016 Jun 2017 Jun 2018 Jun 2019 Jun 2020 Jun 2021 Jun 2022

The spreading of fake and/or misleading SOURCE: TradingView

information is nothing new. It’s been going target a specific virus. The first successful But when must you buy?

on for aeons. The information ecosystem of

today has, however, drastically changed the cross-infection of mRNA, which was packaged So, if the future results of the mRNA

way fake news and misleading information in a liposomal nanoparticle in a cell, was technology are positive, this type of technology

are disseminated and interpreted. Social published as far back as 1989. can only have positive results for possibly the

media platforms and digital technologies The use of RNA in vaccines has led treatment of diseases such as cancer.

have facilitated the sharing of news and to considerable misinformation on social The graph is the medium-term (weekly)

information quite considerably. media, which incorrectly alleges that the graph of CNCR’s share price. Please note that

Within these online environments, fake introduction of RNA can change a person’s it’s a logarithmic scale.

news and information tend to raise more DNA. I am not an expert in this area, but we The ETF remains below its 200-day

interest than news about the truth. But will eventually uncover the side effects of moving average. So, if you buy, remember that

here the cat is among the pigeons. Often the vaccines – if there are any. the long-term trend of the ETF is already in a

one must understand why you are not being This is why the cancer immunotherapy bear phase, should you go against the general

told the truth. When the going gets tough ETF caught my eye. Its code is CNCR, and trend. Keep your exposure low and apply a very

in the world, you can be sure that there will it’s listed on the Chicago Board Options disciplined stop-loss.

be a concerted effort to simply relate what Exchange (CBOE). A descending wedge pattern is currently

everybody wants to hear. What makes the ETF an attractive unfolding (see the black trendlines that are

This currently forms the basis of the investment option? trending towards one another). Such a pattern

usually plays out as a bull price action. The

debate on whether people want to be

vaccinated or not. It remains a personal This ETF consists of a basket of companies purpose of the pattern is indicated by the blue

choice, owing to your right to human dignity. that have developed therapy to treat cancer arrow lines, which are in the region of $36.

One of the vaccines that is central to all by utilising the body’s own immune system. Should the ETF get close to this level, I would

the hype is Pfizer and BioNTech’s It’s therefore similar to the mRNA suggest that you reduce your exposure.

mRNA-based vaccine. technology. I will be more comfortable once the price

This type of vaccine uses Immunotherapy is a action has broken out of the pattern. This level

a replication of a disease to transformation field in the is in the region of $30.

create a so-called message, biotech space that could have a Should the price break through below

namely messenger RNA fundamental impact on cancer $25, one can expect the ETF to decline

(mRNA), to elicit an immune treatment. By developing further. Regard this level as a stop-loss to

reaction. This vaccine immunotherapies that are more protect capital.

therefore stimulates an efficacious and that can lead to a These types of investments could

adaptable immune reaction better quality of life than medicine possibly be long term by nature, so watch

that “teaches” the body to currently available, immunotherapy out for news of any developments regarding

Photo: Shutterstock identify similar harmful cells and then companies can make a difference for the mRNA vaccines. ■

destroying them. The purpose of this type of courageous patients battling cancer. This ETF editorial@finweek.co.za

vaccine is therefore to stimulate the adaptable aims to support this important work and the Peet Serfontein is an independent market analyst and

strategist at Unum Capital.

immune system to create antibodies that positive impact that it will have on society.

16 finweek 10 September 2021 www.fin24.com/finweek

marketplace invest DIY

By Simon Brown

INVESTMENT

Managing real-world market fears

It can be hard to focus on your investment fundamentals when a stock or sector runs hard. This fear is manageable.

Photo: Shutterstock f ear is a stark reality in the markets for There had been no new production in The other very easy

most investors. We fear the markets almost a decade meaning demand was way to manage this fear is

for two key reasons: fear of missing picking up and an undersupply was pushing old-fashioned diversification.

out (fomo) and fear of being wrong. commodities higher. That saw the stocks Here, I like a core holding of

They have some common traits between rise on improved earnings. We fear we exchange-traded funds (ETFs)

them but in many cases are separate and have missed the run, but we can do the with a careful selection of

have different solutions for helping to research and decide whether there is more 10 to 15 individual stocks.

remove the fear. upside or not. From the lows of 2016, the

I have written many times about fomo, resource index added almost 50% in 2016. The other very easy way to manage this

either directly or implicitly. We see a stock We then saw some weakness in the first fear is old-fashioned diversification. Here,

running higher and we worry that there is half of 2017 but since then the index has I like a core holding of exchange-traded

money being made and we’re not making more than doubled. We had real underlying funds (ETFs) with a careful selection of

any of it. Our gut response is then to jump fundamentals driving prices higher and 10 to 15 individual stocks. This gives wide

in without really knowing what’s causing the plenty of time to research and react. diversification thanks to the ETFs and the

run nor how we plan to get out. Often the range of stocks. If one of those stocks goes

fear causes us to enter too late. So, fomo is about knowing which scenario bad or nowhere, the portfolio risk is small,

The key here is to pause a moment and it is and acting accordingly. and we have others to make the serious

ask yourself whether this is just fomo. If profits. Remember that the downside risk of

it is, then sure, get involved, but also be With the fear of being wrong we worry a stock is always only 100% (when it goes

ready to get out quickly. Game Stop in the that we’ve found a stock we love that is bust) whereas the upside is unlimited.

US and Quantum Foods locally are two trading at very attractive valuations and

examples of this, albeit with different forces some of us will jump in and wait for the The last point, of course, is that writing

that set the stocks running. Neither had a returns to roll in, but many of us start to or reading about this is easy. But managing

true underlying fundamental reason for the doubt ourselves and want to see the price real-world fear is harder. Knowing where

run higher and this is the point – a lack of moving first. Then it does, and we worry the fear stems from is the first step in

fundamental reason alerts you to the fact we’ve missed the run (fomo again). overcoming that fear. ■

that this is all hype, and you need to be editorial@finweek.co.za

within reach of the sell button. But a quality stock will run for years

The other situation is when a stock and potentially gain hundreds of percent in

is running because fundamentals are price as we’ve seen with commodities. So,

improving. For example, when commodity waiting and then buying when the move

stocks started moving higher in 2016. starts is a perfectly good strategy. Sure, you

Here we could interrogate the reasons. miss the first bit of the gains, but as I have

written before, every ten-bagger stock (one

that goes up 10 times in price) first must be

a one-bagger.

@finweek finweek finweekmagazine finweek 10 September 2021 17

marketplace Simon says

By Simon Brown

MASSMART Simon’s PURPLE GROUP

stock tips

Offloading Serialong now

and buying Founder and director of investment significant

website JustOneLap.com, Simon shareholder

Massmart announced it’s in negotiations to Brown, is finweek’s resident expert

buy a controlling stake in OneCart, thereby on the stock markets. In this column Back in September 2018, the Serialong

giving indications as to its longer-term Trust led by Bonang Mohale made a R25m

strategy. Parent company Walmart competes he provides insight into recent loan to Purple Group*. The terms were

toe-to-toe with Amazon in the US, and market developments. that 30% of the interest was paid while

they have a majority stake in Indian Flipkart the balance was capitalised and could

which Walmart acquired control of in 2018. SIBANYE-STILLWATER be converted into Purple Group shares

Clearly Massmart is focusing on online retail before the end of August 2021 at a price

locally and Walmart will be able to provide Solid results of 22.87c, being the 30-day average price

strong tech and insights which, coupled with ahead of the loan being issued. Serialong

OneCart, could see the company become a Sibanye-Stillwater* published half-year has elected to convert the loan to shares

meaningful player in the still fledgling online results through 30 June on 26 August which and as a result now holds 11.46% of Purple

retail space in South Africa. were as strong as expected. The company Group. This is a huge profit as the R25m is

declared a dividend of 292c per share (on now worth R189m and makes Serialong,

Staying with Massmart, the company has an annualised basis that’s a dividend yield along with Firefly (who bought almost half

thrown in the towel on some lower-margin of around 10%) while headline earnings of founder Mark Barnes’ shares back in

businesses as it is selling Cambridge Food, per share (HEPS) at 843c places the stock June), two new significant shareholders in

Rhino and Massfresh to Shoprite*. The deal on a forward P/E of under four times. I the business.

is worth R1.4bn, which Massmart will use to would have liked a higher dividend payout,

pay down debt and which Shoprite can easily but the company bought back R5bn of NASPERS

afford. For Shoprite, they can plug these loss- corporate bonds after the financial period

making businesses into their distribution and end and continued a R9.6bn share buyback Swap done

should be able to generate profits quickly. In programme. The company remains my and dusted

time, Shoprite will likely rebrand the chains preferred PGM stock and at current prices it

to the existing Shoprite brands. The deal is extremely cheap, even as PGM prices have The Naspers** and Prosus share swap has

also includes 43 adjacent liquor stores. The moved a bit lower. been concluded and was oversubscribed.That

stores’ total turnover for the 2020 calendar means the full 49% of Naspers shares were

year was almost R11bn. Assuming it’ll cost as The deal is worth swapped for new Prosus shares.This broke

much as R600m to get to break-even on the the JSE as it meant massive sales by passive

acquisition (likely less) and if Shoprite can get R1.4bn holders at the close on Tuesday 17 August.

operating margins of some 4%, they’ll make which Massmart will use to pay The value of shares traded at almost R150bn

around R440m, meaning Shoprite is buying down debt and which Shoprite can was double the previous daily record and the

on a price-to-earnings (P/E) ratio of just over easily afford. exchange couldn’t process the transaction in

three times. This is a great deal for Shoprite. time, resulting in the exchange only opening

at 14:30 the following day.The plan here was

to reduce Naspers’ index concentration on

SA indices, and this has worked to a degree.

Naspers constituted 17.14% and Prosus under

2% of the FTSE/JSE Top40 at the end of June

and is now 7.93% and 8.93% respectively

and together down from almost 20% to 16%.

BHP* is now the largest constituent at 13.3%,

Richemont next at 12.3% followed by Anglo

American at 11.2%.

18 finweek 10 September 2021 www.fin24.com/finweek

marketplace Simon says

COAL MINERS CURRO METAIR

Strong results Energy can give

amid damning a boost

Photos: Archive | Gallo/Getty Images report Disappointing Metair also had their best six months ever with

report card HEPS to end-June coming in at 170c compared

The UN’s climate report, or by its official name, to a headline loss of 56c during the comparable

the Intergovernmental Panel on Climate Curro’s financial results for the six months period. Results were released on 19 August.

Change, makes for some very sobering reading ending June, released on 18 August, were a They’ll benefit from the increasing capacity in the

and is important for several of our listed entities disappointment. The R1.5bn rights issue last export automotive sector, but I worry that they

in the longer term – with coal miners Exxaro year increased the number of shares by 42% are lagging in the energy storage space.They have

and Thungela Resources both in the spotlight. and Curro still has debt of about R4.4bn. top-end stop-start technology in their European

But in both cases they export to markets with HEPS for the period was down 49% while operation, but they seem behind the trend in

relatively new coal-powered power plants and the company added 7% in new learners and the lithium-ion battery sector as electric vehicles

high economic growth. So, while there will revenue was up 12%. The biggest concern is command more sales.That said, this sector is still

be pressure on them, it will likely be decades that the older schools, which are fuller than in the early days and if the company can get a

before their offtake markets start to fade. In the new schools, are only making returns of about strong strategy for lithium-ion energy storage, they

meantime, both companies reported strong 30%. This is in part due to non-payment of could be a large benefactor of electric vehicles.

results even as problems on theTransnet line fees, which the company expects will cost

to the Richards Bay Coal Terminal (RBCT) it around R62m this year, even as Curro SASOL

hampered their ability to get their exports out continues to offer discounts to parents. I hold

of the country.Thungela is now trading at more ADvTECH* and their results due 31 August Back in the

than 6 000c per share after listing at just above will likely be much better after a strong black?

2 000c. At listing I liked the valuation, but it is trading update, expecting HEPS to be about

now fairly priced, and I would not be entering 30% higher. Sasol’s full-year results through 30 June,

new positions at current levels. released on 16 August, showed a company which

The biggest concern is has avoided hitting the wall. Debt has come

ARB HOLDINGS that the older schools, down markedly but not enough for the company

which are fuller than to declare a dividend.The issue here is that it is a

Profits make it new schools, are only much smaller company, having had to sell several

worth a shot assets. Some of these former units will now sell

making returns of products to Sasol, reducing the latter’s margins.

ARB Holdings’ results for the year ending June, about 30%. For me the point that mattered most was the

released on 19 August, saw HEPS of 82.49c, recent UN climate report which sits with Sasol

up on 2020 but also up 41.7% on 2019, making squarely in its sights as a significant polluter in

this the best year ever for ARB. Sure, they SA. I’m not sure how this will play out, but I will

added to their lighting division which skewed be watching as someone who doesn’t own the

this statistic in their favour, but we also saw a stock. ■

dividend of 32.5c per share and a 10c special editorial@finweek.co.za

dividend, putting the stock on an 8% dividend

yield. Higher copper pricing has hurt profitability *The writer owns shares in ADvTECH, BHP, Sibanye-Stillwater,

to a degree, but their cabling business is well- Shoprite and PurpleGroup.

positioned, especially as we see new 100MW **finweek is a publication of Media24, a subsidiary of Naspers.

power generation rolling out.This is never an

exciting stock, but it is of high quality with great

management and worth a look for anybody

wanting some exposure to SA stocks with most

of their business domestically, especially in the

infrastructure space.

@finweek finweek finweekmagazine finweek 10 September 2021 19

marketplace investment

By Amy Degenhardt

ECONOMY